Welcome in my detailed report of my Investment in 2023

New year and new track record page.

I made some changes on the graph type.

I decided to move from an area chart to an histogram for the monthly review.

You can follow my 2023 Investments here.

January

January Investment

Unrealized gain/loss January: + € 50

Unrealized gain/loss total: - € 254

Total money invested € 13,053

Unrealized gain/loss in percentage: - 1.95%

February

February Investment

Unrealized gain/loss February: + € 72

Unrealized gain/loss total: - € 181

Total money invested € 15,553

Unrealized gain/loss in percentage: - 1.17%

March

March Investment

Unrealized gain/loss March: + € 357

Unrealized gain/loss total: € 175

Total money invested € 18,053

Unrealized gain/loss in percentage: 0.97 %

1st Quarterly Comment

The first quarter is finished pretty good with almost 1% gain. I'm generally satisfied.

I started to invest also in bonds (TIPS) trying to lower the volatility of my portfolio and in April I'll invest to bring them to 10% of my portfolio. Thus, April will have strange investment installments to rebalance the portfolio. I also have to change my Gold ETF because the one I'm investing into is no more supported in Italy, so I will move from XGDU --> SGLD. I think I'll maintain both of them without selling the first and only adding both under Gold.

My investments should continue to be € 2500 monthly until the end of the year. I will see next year if something changes.

See you next end of quarter 👋

April

April Investment

Unrealized gain/loss April: + € 60

Unrealized gain/loss total: € 236

Total money invested € 20,358

Unrealized gain/loss in percentage: 1.16 %

April Comment

As you can see I changed a bit my investment. I noticed I used wrong data in the past to create my portfolio, so I made again my analysis and decided to change it quickly. The new Gold ETF is because the old one cannot longer be sold in Italy because it doesn't have the KIID (Key Investor Information Documents) in Italian.

May

May Investment

Unrealized gain/loss May: + € 760

Unrealized gain/loss total: € 995

Total money invested € 22,859

Unrealized gain/loss in percentage: 4.35 %

May Comment

IT Sector ETF had a big jump in the last month. If it continues in this way I think I'll invest less in it in the next months. I don't trust too much this new NVDA price and the bubble around the AI. In any case I hope to be wrong.

I appreciate the market have left behind the bear market and it seems it is going towards a bull market without passing the recession phase. Let's hope so!

In any case, I appreciate my new strategy.

See you next month 👋

June

June Investment

Unrealized gain/loss June: + € 301

Unrealized gain/loss total: € 1296

Total money invested € 25,359

Unrealized gain/loss in percentage: 5.11 %

June Comment

The market seems to be sure that the recession will no happen in the future. The inflation is going down without mining the U.S. economy. Good!

I always have the presentiment goings could go worse from one moment to another.

In any case next month I'll invest the double compared to the previous months.

We will see what will happen.

In August or September I think I'll have to rebalance the Portfolio to lower the IT quote. We will see.

See you next month 👋

July

July Investment

Unrealized gain/loss July: + € 785

Unrealized gain/loss total: € 2,081

Total money invested € 30,359

Unrealized gain/loss in percentage: 6.85 %

July Comment

As I said the last month I increased my quantity invested.

Investors are pretty sure that there will be no recession. I have my doubts.

I don't seem so coherent with myself, I have just increased my monthly investment.

Anyway, I have these money, I have to put somewhere and I don't want to predict the market.

Dead investor is better than active investor.

I'm driving to 50k invested for December! 😁

See you next month 👋

August

August Investment

Unrealized gain/loss Month: - 225,01

Unrealized gain/loss total: € 1,856

Total money invested € 45,998

Unrealized gain/loss in percentage: 4.04 %

FI Date: 01/08/2165 (140 years seems to much 😅)

August Comment

Sure! I changed everything again.

I solemnly promise it's the last time.

I'll explain how the situation arose.

I was fully invested in the US, which I continue to believe is the dominant investment nation for at least the next 50 years. They have a financial system and a mentality of doing business that is completely different from that of other countries in the world.

However, there is always a black swan in the financial markets. That event which is unexpected and destroys everything. So I had looked for something to defend myself from what happened. Here, do you see those €126 losses? They are ETFs that I had taken to protect myself and invest against my strategy. I had also done a few days of analysis (more than a few days)

Then I remembered that "Dead investor is better than active investor". Like I wrote last month and said fuck it all I buy myself the whole world.

New Strategy

I was torn between MSCI ACWI, ACWI IMI and FTSE All-World indexes. In the end I took ACWI because I don't pay commissions on my broker and it had a lower spread. Two taxes avoided with one investment. Furthermore, ACWI and All-world have identical returns, while ACWI IMI also gives exposure to small caps, but the influence is minimal.

I just bought some gold as protection against a global catastrophe. Also, I sold the gold that could no longer be bought in Italy and now I'm done with my investments.

I think I will focus more on increasing my earnings rather than earnings from the market.

Last change I will invest all the money I can afford every month, so you will see months of 15,000 and months of 1,000 euros, don't worry. I simply reasoned (and did some calculations) that spreading the investment over time, unless you're sure of a crash, is counterproductive. As we expect the value of our assets to rise over time, the longer we wait, the less we buy at a time.

I added also the FI date, it works subtracting the actual net worth to the Capital End Target dividing for the amount of money invested in that month.

I almost reached the 50k invested! 😁 (it was easy)

Next temporary goal 75K!

See you next month 👋

September

September Investment

Unrealized gain/loss Month: - 1025

Unrealized gain/loss total: € 831

Total money invested € 59,973

Unrealized gain/loss in percentage: 1.44 %

FI Date: 01/08/2093 (70 years is better than 140 😅)

September Comment

😕 Bad month, I hope in better October.

I decided from next month to use the CAPE to modify my asset allocation to reduce my exposure to Stocks when CAPE is higher.

I don't have to much to say because there is nothing to say.

3rd Quarterly Comment

Third quarterly was good until September, but the most important thing is that I modified my monthly investments, my asset allocation and found one that is more suitable to my actual mental situation.

I'm still confident that this year can conclude with a positive return. In my opinion September was penalized more than the reality was demonstrate by the news and the data.

I hope you continue to follow my blog to see how it goings forward over time!

See you next end of quarter (if I don't forget it) 👋

October

October Investment

Unrealized gain/loss Month: - € 1,730

Unrealized gain/loss total: - € 899

Total money invested € 67,940 + Gains in previous investments: € 1,106 = 69,046

Unrealized gain/loss in percentage: -1.32%

FI Date: 01/05/2183 (160 years 😕)

October Comment

😕😕😕 Bad month, I hope in November.

At least Cape is going down so I'm buying discounted ETF (in theory).

I made some little changes to the table so it should be more readible.

November

November Investment

Unrealized gain/loss Month: € 2,372

Unrealized gain/loss total: € 1,473

Total money invested € 75,072

Unrealized gain/loss in percentage: 1.96%

FI Date: 01/07/2121 (98 years 😕, still too much)

November Comment

Objectively November was better 🚀🚀🚀, let's see how the year ends.

I wanted to add some savings and cashflow data to improve reporting, but I think I'll start in the new year.

Goal of €75,000 reached 🏅, let's try to finish the year with €80,000, even if I will have some important outgoings, so I will probably invest less money from next month 😬.

December

December Investment

Unrealized gain/loss Month: € 2,676

Unrealized gain/loss total: € 4,149

Total money invested € 78,672

Unrealized gain/loss in percentage: 5.27%

FI Date: 01/03/2132 (continue to increase...)

December Comment

Always a satisfying end to the year, the markets are already discounting the drop in rates and it doesn't make me enthusiastic.

I'm afraid to sell the bear's skin (the recession) before it's dead.

I think in January I will focus a little more on gold and bonds. I see shares as expensive considering the various crises in the world and the high expectations of investors.

Let's see who will be right.

4th Quarterly (and Yearly) Comment

Completed first year as a full time investor and also first year of continuing to blog.

I like it even if I don't see any readers. It doesn't matter much, since it's more for me than for others.

I wanted to create some kind of in-depth course on personal finance, but let's see how next year goes.

Goals for next year:

Stay with this wallet (I like it and it makes me calm)

Continue with the strategy that seeks to use CAPE to prevent systemic crises

Try to be as dead as possible for the rest

I wish those who read a happy new year (even if you read it in 2135 😂).

Let's see in 2024! 🎉

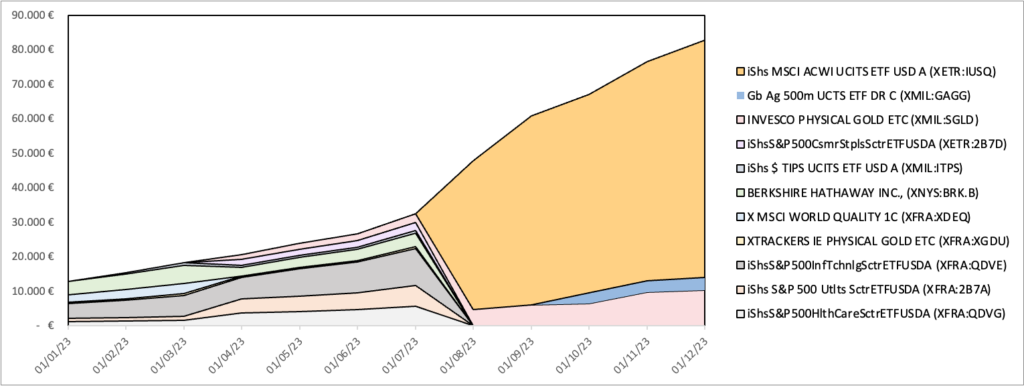

My portfolio through the year