Uncorrelated assets lower the investment risk.

Let's see what correlation and diversification mean for a moment.

Correlation between 2 assets

In finance, correlation is the relationship with which 2 investment instruments move.

The correlation varies between +1 and -1.

+1 means that the instruments move in the same way.

-1 means that the instruments goes in exactly the opposite way.

Example

Stock A:

expected return 10%

volatility 5%

Stock B:

expected return 6%

volatility 2%

We have to use a formula to calculate the volatility of a portfolio.

SD(R) is the standard deviation (volatility of our portfolio)

For a 50%-50% wallet:

If the correlation were equal to 1, the expected return is the average of the 2 shares, therefore 8%.

Volatility also, 3.5%.

Correlation does not imply the strength with which they rise, but the moment in which they do so. With a correlation of 1 it means that they rise at the same time even if one with 10% and another with 5%.

But with a correlation of -1?

Well, the expected return is always the average so 8% and volatility? It becomes 1.5%.

We can even make it zero if we decide to have a portfolio of 71.42% in B and 28.57% in A. The yield would become about 6.42%. In this case sure, having no risks.

Where is the catch?

1. Completely uncorrelated assets (-1) do not exist, especially in the long run.

2. The correlation in a portfolio is difficult to estimate

If it is difficult to calculate and estimate, what does it help us to do?

Well it makes us reason that the concept of diversification is true. All eggs in one basket isn't the best idea.

But diversification must also be done on the basis of correlation, this makes diversifying really useful.

Diversification

Diversification is important, but it must not be done excessively. We have seen before that diversification is useful to reduce the risk of our investments.

What if I told you that a few stocks are enough to emulate, if not exceed market performance, while maintaining modest risk?

Well, Warren Buffet does it and his portfolio has about fifty stocks in total.

In reality Warren has a lot of data more than us and knowledge of the markets that allows him to know in advance and speak directly with the management of the companies. Moreover with his capital, if he buys too little companies, he can take the complete control. It will be no more investing, but doing business

His is another game, he can spend days and teams of analysts evaluating a company.

We do not.

We have to work or do something else in our life, but we can take the best of him to imitate him. It is another game.

We have learned that although we want to invest in ETFs, therefore baskets of stocks, we may only need 2 ETFs to outperform an ETF on the S&P 500.

Let's see how:

From here we can see the correlation between the various industries of the S&P 500.

If we take an IT ETF and one on Health Care.

These are the 5-year returns and volatility at the time of writing this article.

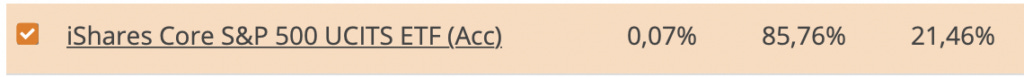

The first column is the TER, the second the return over 5 years and the third the volatility over 5 years.

Let's try to see the average

For the annualized return, we need to use this formula:

For the first ETF we have a monster return of 20.68% and 13.82% for the second.

And Volatility?

The volatility is yet an average over the 5 years.

So we can use the formula used before.

With a 61.5% invested in Health Care sector and a 39.5% in IT sector we can reach an annualized return over 16% and a risk of 21.46%.

This is an ETF on S&P 500

The annualized return is about 13%. With only 2 ETF we increased our return of 3 points with the same volatility.

The total stocks in our hands reduced from 500 to 77 + 65 = 142 stocks.

So we have less stocks, but greater return.

We could have done better by adding utilities which are even less correlated than the other two asset classes.

We created a better portfolio than before with less stocks, so Warren Buffet is doing right!

Yes, but as I said before it is difficult for us to emulate it, except by buying a share of Berkshire Hathaway, which is expensive. Furthermore, being a company, it could have problems in the future with the handover when Buffet leaves us.

I wanted to use correlation and diversification to my advantage, while still leveraging Warren Buffet to achieve high returns as you can see in my portfolio allocation.

I'll leave you the theory about efficient portfolio in the bonus link. Read it, it is important!

P.S.

During panic selling and market crash, correlation stop to be relevant and it is the moment when there are discount in the markets and it is more likely to invest into.

Bonus link: