Large investors also fall into investment biases.

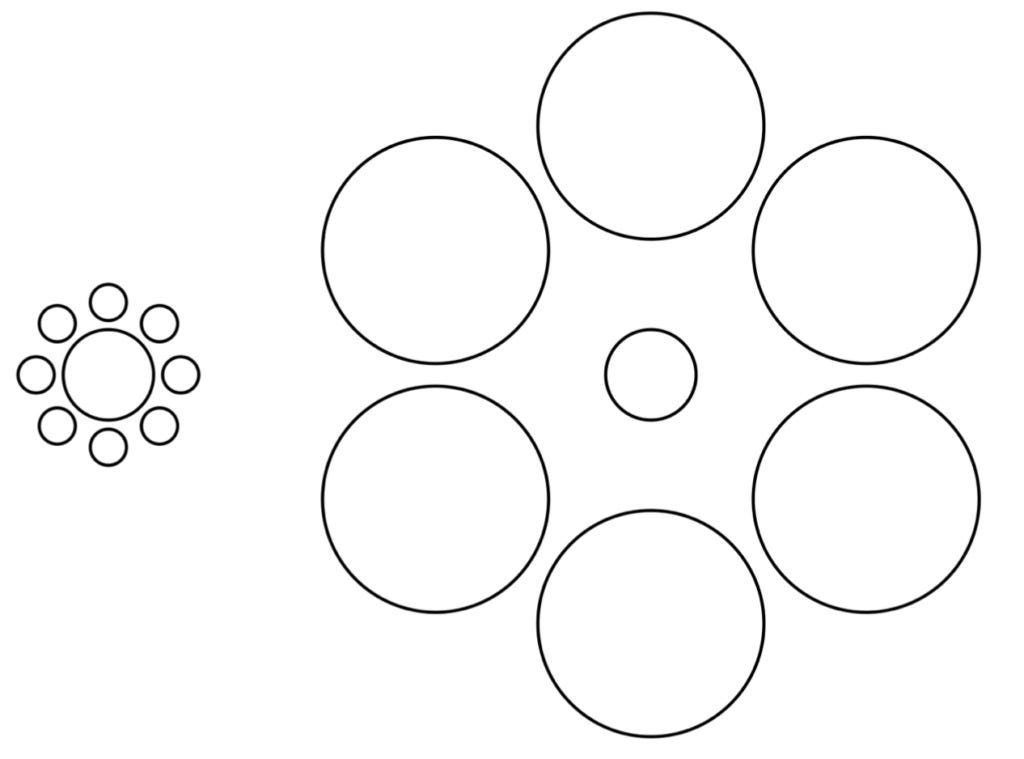

Let's start from a concept, The way you perceive things is influenced by other things (e.g. the outer circles). Which of the two inner circles is larger?

Our brain is bad at perceiving absolute values. It's all relative. By knowing this, you can consciously adjust for the difference. But this doesn't necessarily change your actual perception.

Cognitive biases

Let's now move on to the cognitive biases that our brain undergoes. From a very large set of (financial) information, we only select a subset to make decisions. This subset selection is detrimentally influenced by availability biases. What are availability biases? They are divided into 2 types:

Home bias: Over-invest in “local” (your country) companies

Recency bias: Overweight recent information (last Tv news)

So remember, don't focus on readily available data! Do extensive research and go out of your comfort zone.

Other important biases in investment are:

Anchoring bias: when we are asked to estimate something, we tend to be influenced by other (unrelated) numbers we recently encountered.

Confirmation bias: we tend to look for information that confirms our beliefs and ignore information that contradicts them.

We may also face biases regarding our own and other investors' performance analysis methodology.

Hindsight ("I knew it") bias: If the performance of an investment turns out to be as expected, it is still only one outcome among others that were also probable (at least to some degree).

Bias blind spot: You might see other people's biases, but not your own.

Overconfidence bias

And then there is the most damaging bias in my opinion, that afflicts all of us in some way in life.

A simple question: "Do you think you are an above average driver?"

93% of American drivers said they were above average (median) drivers. But wasn't the average the 50% of the sample? 😂

As you can see, we tend to overestimate ourselves.

Overconfidence comes in many forms

Overestimate your actual performance

Overestimate where you rank among your peers

Being overly sure about your beliefs

Remember to always question your certainties and what you believe in, check the calculations and analyze several times, look for more sources. But above all, leave the calculations there for a few hours and come back after going out with friends or having done an hour of the gym.

At that point you can double check everything.

Beyond all these biases there is the usual fear in the markets, aversion to losses and FOMO (fear of missing out) which makes us invest in a reckless manner and without adequate analysis.

Disposition effect

All this manifests itself in the Disposition effect

People have a tendency to:

Sell their winning positions too early

Hold onto their losing positions for too long

What would you have regretted more?

Selling a share of Apple 20 years ago,

Or passing up the opportunity to buy a share of Google 20 years ago?

Remember, the right way to think about this: "If I didn’t own that (losing) position, would I buy it now?"

Always remember that these biases can also appear at other times, not just in investments. I advise you to check them so as to overcome them and give your best in every area.

Bonus link:

10 cognitive biases that can lead to investment mistakes

Cognitive vs. Emotional Investing Bias: What’s the Difference?