I have already talked about ETFs and currency risk and I have already written in that article the short solutions to solve the problem. But today I would like to do a more complex analysis and explain how a hedged ETF works and how we should include it in the portfolio.

What is currency risk?

Currency risk refers to the possibility that the value of an investment will be affected by fluctuations in the exchange rates between two currencies. Let's take the case an investor buys an ETF that invests in US stocks. Assume the day after the exchange rate between the US dollar and the Euro changes unfavorably. Put a 10% less, the value of the ETF will decrease of 10%. In other words, the investor could suffer a loss despite the stock in the ETF doing well.

How does currency risk work in ETFs?

Most ETFs have implied currency exposure, which means investors may be exposed to fluctuations in exchange rates even if they haven't actually purchased a foreign currency. For example, if an ETF invests in shares of US companies traded in euros, the investor indirectly holds dollars, even if the money is converted into euros when the ETF is purchased.

We have 3 definitions to learn:

Currency of denomination. Expresses the currency underlying the ETF. For a S&P500 ETF is always US dollars.

The quote currency. The quote currency for instruments listed on Borsa Italiana (for example) market is always the Euro. In the event that the Currency of denomination is different, which is very frequent, the asset is converted on Euros.

Effective exchange rate risk. It summarizes the two previous information and explains the exposure to exchange rate risk to which the Italian investor is subject. In some cases, ETFs are of the hedged type. That is, they have assets denominated in foreign currencies in their portfolio but which, do not present exchange rate risk for the Italian investor. This is made through hedging implemented with the appropriate use of derivative instruments.

Exchange rate risk can be magnified in some situations. For example, if an investor buys an ETF that invests in a country with a currency that is relatively volatile or subject to unpredictable fluctuations, the currency risk may be greater. Also, if the investor uses leverage to invest in ETFs, the currency risk could be magnified.

How to manage currency risk in ETFs?

There are several strategies investors can use to manage currency risk in ETFs.

Currency hedging. One of the most common strategies is currency hedging. Which involves using financial instruments such as futures contracts to protect your investment from fluctuations in exchange rates. Currency hedging can be particularly useful for investors who have strong views on the direction of exchange rates and want to protect their investment from adverse movements. But that is hardly our case. On the contrary currency hedging also has one main disadvantage. It is more expensive, as the ETF has to pay a premium for using the futures contracts. Moreover over a long period of time the same investment can see it's return reduced by more than 20%.

Currency diversification. Another strategy for managing currency risk in ETFs is currency diversification. The idea is to physically hold some currencies to be able to buy/sell in case of a strong spread between 2 of them. The solution is quite simple, but expensive in the case of large assets and could lead to additional risks, such as that of holding currencies.

Does hedging make sense?

The answer to the question of whether or not to choose hedged ETFs is not unequivocal and depends on 2 considerations. The function that the instrument has in the portfolio and on the strategy one is following. To be precise, the choice of whether or not to hedge currency depends both on the type of instrument we buy and on the time horizon.

Assume the example of buying Brazilian government bonds, the impact of the exchange rate will be much greater. For the simple reason that the variability of the exchange rate itself greatly affects more on total return. When we buy bonds in currencies, in essence, our investment becomes almost entirely a "bet" on the exchange rate.

And if we buy stocks ETFs?

Hedged ETFs generally have the suffix HDG or Hedged in their name.

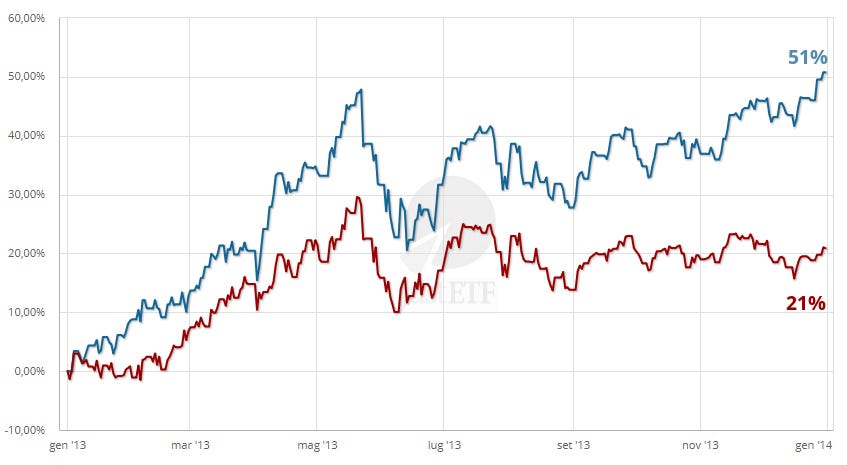

In the short term, the exchange rate may be material to overall return and hedged instruments may outperform non-hedged instruments.

iShares MSCI Japan UCITS ETF (Dist)

iShares MSCI Japan EUR Hedged UCITS ETF (Acc)

Instead, in the long run the situation appear reversed. On the one hand, non-hedged ETF instruments generally return much higher returns than hedged instruments.

This happens, first of all, because hedged instruments allow for an automatic and natural compensation of the underlying that hedged instruments do not have (implicit hedging costs).

In addition there are also the explicit costs as hedged instruments cost much more than non-hedged instruments. In the short run, this higher cost may even be sustainable, but in the long run it risks being too high and weighing too heavily on returns.

Summing up, whether to buy hedged bond ETFs or equity ETFs, currency hedging may not make sense. All depends on our investment strategy.

Exchange rate risk analysis

Finally, investors can use currency risk analysis to identify the specific risks associated with a particular ETF. This may include analyzing correlations between currencies and assessing geopolitical risks that could affect exchange rates. For example, if an ETF invests in Chinese companies, the investor should be aware of China-specific political and currency risks, such as the volatility of the Chinese yuan.

For the way I invest, in the long run, hedging makes little sense. Losing part of your earnings for temporary coverage makes little sense. In the long run, hard currencies tend to keep each other in balance as they help states to maintain their economic power.

In any case, for temporary coverage with respect to particular crisis situations, I think I could consider it in the future.

Site tips: