Achieving early retirement might seem like an unattainable goal for many. But with the right financial approach, investment mix, and a healthy dose of frugality, it can become a reality. In this article, we'll explore the power of compounding and frugality for early retirement. We will see practical examples of how these concepts can transform your financial situation.

The power of compounding

Investment compounding is a key concept for early retirement. If we assume an investment of one dollar a month, adjusted for inflation and compounded with an annual return of 5%, can accumulate almost 1,500 dollars after 40 years. This surprising effect is due to the fact that the interest generated is reinvested. This allows your capital to grow exponentially over time. However, the importance of compounding decreases if the investment period is shorter, as in the case of 150 months (12,5 years), where the accumulation shrinks to about $206. This underscores the importance of starting investing as early as possible to make the most of the power of compounding.

The Power of Frugality

Frugality, the ability to save a greater percentage of monthly income and reduce expenses, plays a key role in early retirement. Assuming you shoot for a 4% withdrawal rate you lower the target Portfolio Value by a full $25*12=$300 if you can keep up that reduced spending during retirement as well. This implies that frugality not only provides more money to invest, but also shortens the time it takes to achieve financial independence. By reducing your monthly expenses and living below your income, you can accumulate more substantial assets and reach your goal of early retirement in a much shorter time frame.

Early Retirement Practical examples

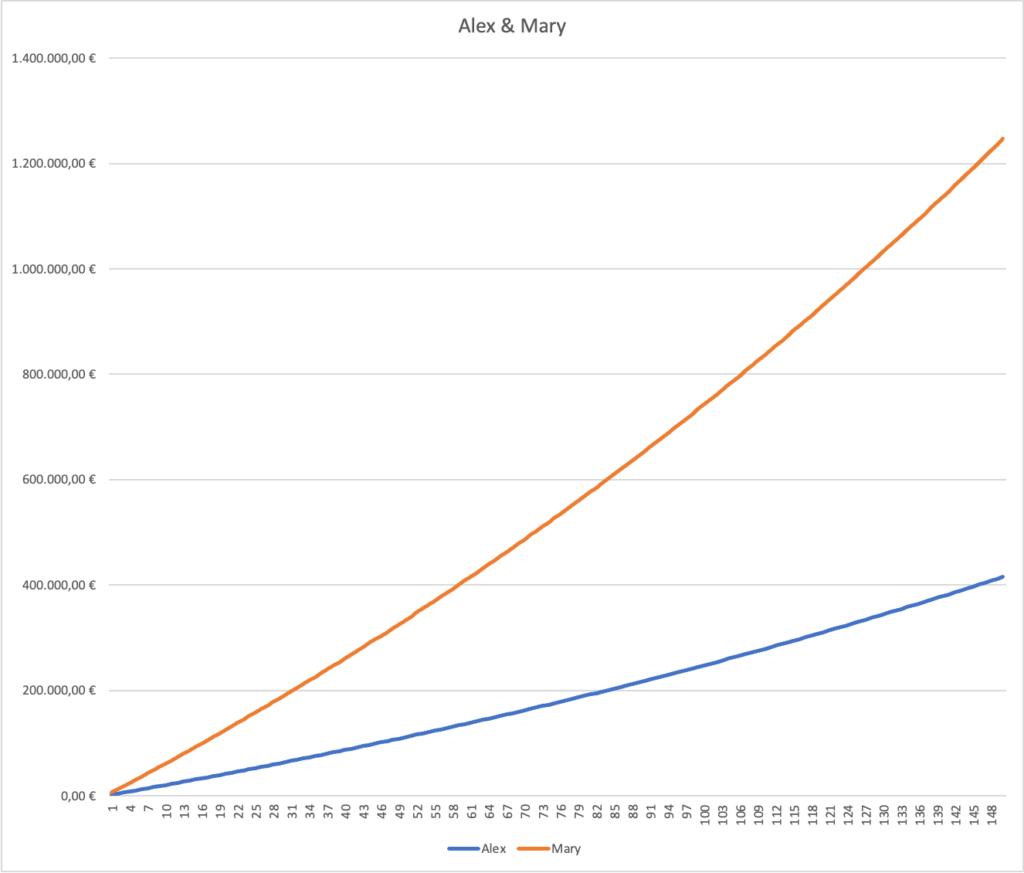

To illustrate the concepts mentioned above, let's consider two individuals: Alex and Mary. Alex saves 20% of his monthly income and consumes $8,000 a month, while Mary saves 60% and consumes $4,000 a month. After 150 months, Alex has amassed $412,459. Which can generate about $1,375 a month in real terms at a 4% drawdown rate. This represents only 17% of the level of consumption Alex was accustomed to. On the other hand, Mary has amassed $1,237,377 over the same period, which he can finance about $4,125 a month, more than enough for his $4,000 level of consumption.

The example of Alex and Mary clearly demonstrates how frugality can have a significant impact on reaching early retirement. Despite both saving for the same amount of time, Mary manages to accumulate three times Alex's savings thanks to her more frugal lifestyle. Using only half of Alex's monthly budget, Mary manages to reduce the time it takes to retire by about two-thirds. This example demonstrates that even the reduction in expenses has a major impact on the path to early retirement.

Furthermore, the importance of investment composition becomes evident in the case of Alex and Mary. While Alex has accumulated respectable savings, his investments are not sufficient to support a similar level of consumption. As he had during the accumulation period. On the other hand, thanks to the combination of savings and investment composition, Mary has accumulated assets that can easily finance his desired level of consumption in retirement.

However, the lesson to be learned is that both investment composition and frugality are essential elements in achieving early retirement.

Conclusion

Early retirement may seem like an ambitious goal, but through investment mix and frugality, it can be achieved. By harnessing the power of compounding, your investments can grow exponentially over time, allowing you to amass significant wealth. At the same time, by adopting a frugal lifestyle and reducing expenses, you can speed up the accumulation process and reduce the time it takes to achieve financial independence.

Remember that every small step towards frugality and investment can make a difference in reaching your early retirement goal. Get started today by evaluating your expenses, looking for ways to reduce them, and planning an investment plan