Bonds are always important in our investment strategy. Emerging country bonds are financial instruments issued by countries that are considered to be economically developing. Emerging Countries are nations that are undergoing economic development and are trying to reach the level of developed Countries in terms of infrastructure, industries and living standards of the population. These countries are often characterized by a growing economy, but also by significant challenges. Poverty, corruption, political instability and economic uncertainty are some of them.

These bonds offer investors the opportunity to diversify their portfolio, seeking potentially higher yields than bonds issued by developed countries. However, investing in emerging market bonds also involves significant risks which should be carefully considered.

Emerging Countries Bonds: Yield

One of the main reasons for investing in bonds of emerging countries is the possibility of obtaining a higher average expected return compared to bonds issued by developed countries. As these countries are experiencing economic growth, they may offer higher interest rates to attract investors. This could offer attractive yield opportunities for investors looking to increase their income.

Emerging Countries Bonds: Risks

However, it is important to underline that investments in emerging market bonds also involve significant risks.

As we talked before, one of the main risks is the economic and political instability of these countries. Sudden changes in economic policies or political landscapes could have a negative impact on a country's ability to meet its bond payment obligations. This happened in the past with Argentina as example known to all.

This risk is called default probability.

Putting it into practice. The expected return of the bond (rd) is: rd = 1 − p∙y + p∙y − L = y−p∙L

Y is the yield to maturity

P is the probability of default

L is the expected loss

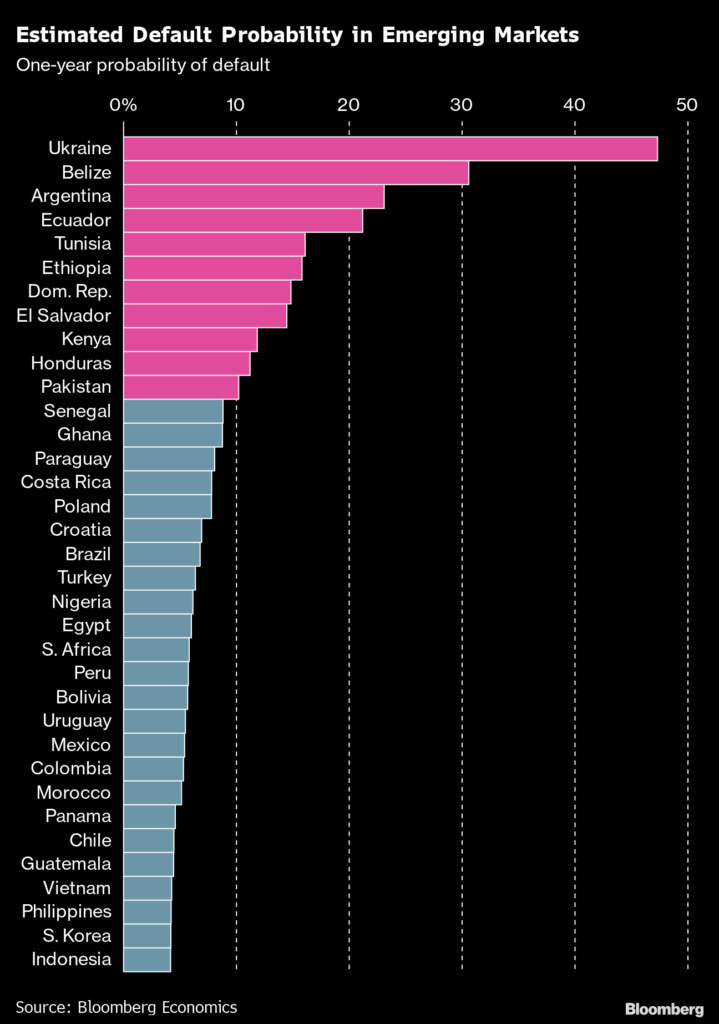

We can assume the picture at the left is the real default probability, not having further information.

Suppose a Senegal Bond has a yield of 6,25% and the probability of default is 9% as Bloomberg says.

The real yield is 6,25% - 9%∙6,25% = 5,69%.

If you diversify your bond investments the real yield should be the average real yield of your bond portfolio.

The one before is not the only risk.

Furthermore, Emerging Countries may be subject to currency risks. Fluctuations in exchange rates may adversely affect the return on investments in emerging market bonds denominated in foreign currencies. Traditionally the bonds are repaid in local currency. Unfortunately, in the last 20 years, a common feature of many emerging currencies has been precisely that of devaluing rather constantly against strong currencies. In addition, these countries may have limited access to global financial markets. The consequence is that they may be subject to capital movement restrictions, which could complicate the bond redemption process.

Another reason why some investors may be hesitant to invest in emerging market bonds is the lack of transparency and financial reporting standards. The economic and financial data of emerging countries may not be as reliable and complete as those of developed countries. It makes difficult to accurately analyze the risks associated with investments.

We have seen that the risks are really many compared to the promised high return.

Alternatives

Alternatively, there are several alternatives that investors could consider:

Bonds of developed countries. Lower yield lower volatility. Investors may opt for bonds issued by developed countries, such as the United States, the United Kingdom or Japan, which are generally considered less risky than bonds of emerging countries. However, yields may be lower than emerging market bonds.

Corporate Bonds. Bonds issued by companies can offer attractive yields and could be an alternative to emerging market bonds. They are more risky than developed countries, but less than emerging markets. Default is still a problem, but currency and transparency are cancelled. The real yield are not so different from the ones of emerging countries. I suggest you to don't go lower than investment grade.

US denominated Emerging Countries Bonds. To be more attractive and limit currency risk, some nations issue their bonds in dollars at lower interest rates. Unfortunately it can happen (not too rarely) that they are unable to repay the debt anyway. Eliminate the currency risk directly, but the nations always with their currency must then buy dollars to repay their debts. Pay attention!

I suggest that you do not consider emerging market bonds at all. As I consider them more speculative investments than anything else. Too many risks, few certainties and a promise of high returns make them seem more like a gamble to me.

Site tips: