Factor investing is based on finding a specific attribute shared by a group of assets that has historically had a significant impact on investment performance.

Today we will see why we shouldn't give them too much consideration.

Over the past 50 years, numerous academic works have sought to identify factors to overperform the market. In effect, the factors are market anomalies that contradict the efficient markets hypothesis.

Some factors, for example, are linked to biases in investor behavior, such as aversion to losses or the continued propensity to follow trends. Others, however, are only valid during certain phases of an economic cycle. One famous factor is the trend of the market perform better in the first half of the year and downperform in the second half.

"sell in May and go away”

-popular saying in the markets

Factors are also often used to construct core/satellite portfolios

Examples of factors can be:

Size (Big vs small caps)

Trend (Momentum vs Contrarian)

Valuation (Value vs growth)

Fama & French

Fama & French studied (actually still do) the outperformance in the history of value and growth factors.

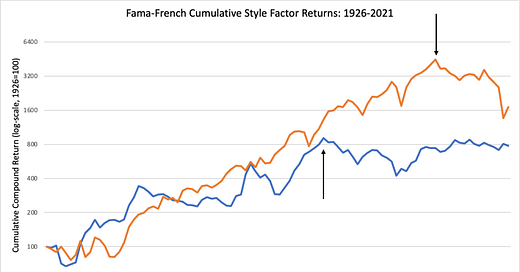

The orange line is the Value minus Growth performance (HML), while the blue line represents Small minus Big companies (SMB).

Data were taken from Prof French's website

To understand the graph, one must keep in mind that what is represented is the outperformance compared to the general markets.

It means that €100 invested in 1926 in SMB would have yielded €800 more than the market average in 1983. Not bad!

Naturally, this consideration only applies if the money had been kept invested for the entire period and the asset allocation had not changed over time.

In correspondence with the 2 arrows the trend has stopped (horizontal movement) for SMB and reversed for HML downward movement.

There are 2 possibilities that the trend has reversed/stopped.

Bad luck. Obviously on short horizons, the factors stopped or reversed course even over the course of several decades (1944-1965 SMB). If this is the case, we shouldn't worry about poor performance in recent years. A return to consistent size and value performance should be just around the corner!

The party is over. The market anomaly of the 2 factors has been detected, studied and disseminated to the general public. Therefore, they can no longer be used to predict future outperformance.

Why shouldn't we be interested in factor investing?

Because we try to beat the market, not unlike market timing. If all investors were to know about this strategy (and they do now) then the market would readjust itself so as not to give extra returns. Likewise predicting the value of stocks based on when interest rates will be raised or how unemployment is going.

If a factor is discovered, it is usually done by large banking or investment institutions. It's hard to get disclosed before they can cash in on it and be sure the trend works. Ergo we would only discover it when it is obsolete. Ours would be late factor investing.

As usual these are my views on factor investing and I always recommend reading articles for and against factor investing.

Site tips: