Welcome in my detailed report of my Investments for 2024

New year and new track record page.

We will continue with the same style (at least at the beginning).

You can see previous year here.

January

January Investment

Unrealized gain/loss Month: € 2,276

Unrealized gain/loss total: € 6,426

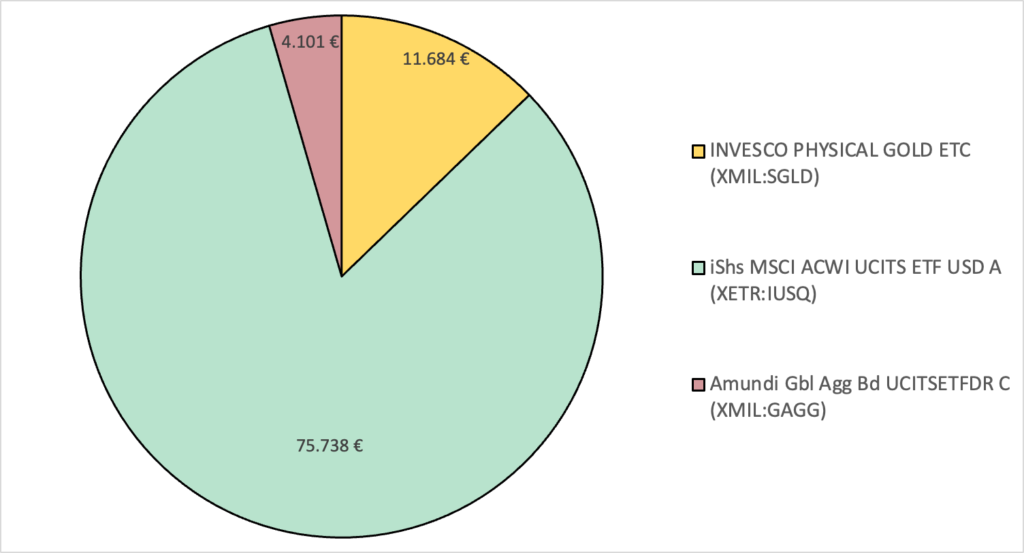

Total money invested € 85,097

Unrealized gain/loss in percentage: 7.55%

FI Date: 01/11/2220 (continue to increase...)

January Comment

Markets seems to have started a new rally, but only the USA BigTech are growing. Not so enthusiastic also because I invested in ACWI. China always deeper.

I should be happy because my portfolio is growing, but I fear why it happens.

Maybe I'm overthinking.

February

February Investment

Unrealized gain/loss Month: € 2,514

Unrealized gain/loss total: € 8,940

Total money invested € 89,337

Unrealized gain/loss in percentage: 10.01%

FI Date: 01/09/2090 (thanks Mr. market, I gained 130 years 🤣)

February Comment

The US Large Cap market rally seems to continue, NVIDIA ha doubled the revenues in in 1 year (AI is a new real trend like internet or a bubble?).

Value stocks are ignored by investors as like as China and Europe. Wealthy will continue to be a dead 💀 investor. No matters what will happen.

Other doubts are on when Interest rate will be cutted?

I hope before June.

Good point I'm near € 100K 🎉🎉🎉

March

March Investment

Unrealized gain/loss Month: € 4,029,2

Unrealized gain/loss total: € 13,250

Total money invested € 89,337

Unrealized gain/loss in percentage: 14.83%

FI Date: 01/07/2108

March Comment

I made € 100K 🎉🎉🎉

I didn't invested this month due to problem with my bank. I have € 20K blocked. Thanks BBVA 😡

I'm moving to ING, let's see how much time we need to open the account.

I hope to invest in April, without issues.

April

April Investment

Unrealized gain/loss Month: - € 937

Unrealized gain/loss Total: € 12,313

Total money invested € 91,337

Unrealized gain/loss in percentage: 13.48%

FI Date: 01/12/2312

April Comment

Another month with low investment amounts, due to the problem with BBVA. In this first days of May, I received my money from them on ING. I'll invest the money in May and June to return on the right way.

Stocks are going down from the rally, while Gold continue to increase. Increaser in gold sounds no good to me. We will see in the future.

Finally, the UCITS Developed ex US ETF is arrived from Xtrackers. ISIN: IE0006WW1TQ4.

Next month I'll move to divide my ACWI in 3 ETF:

US

DEV ex US

Emerging Markets

More next month!

May

May Investment

Unrealized gain/loss Month: € 969

Unrealized gain/loss Total: € 13,282

Total money invested € 96,289

Unrealized gain/loss in percentage: 13.79%

FI Date: 01/3/2091

May Comment

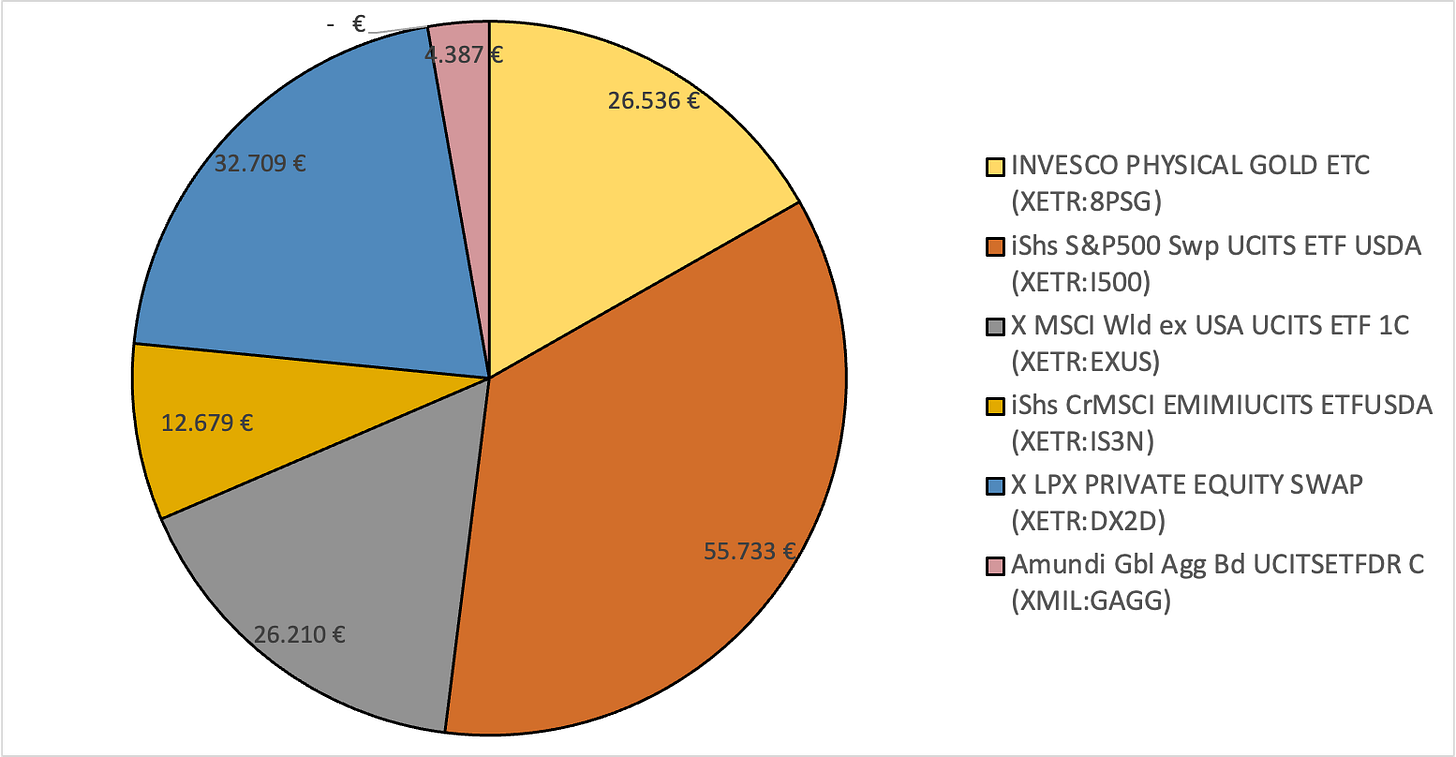

As mentioned last month I made a change to better control the weight of the United States and the rest of the world on my portfolio.

I decided to split the MSCI ACWI ETF into 3 ETFs (SP500, World ex US and EM) and to integrate an ETF on companies that invest in Private Equity to have exposure to this market in which we cannot directly invest through ordinary markets.

For the moment I have given a weight of 20% to the private market, I do not yet have a precise idea of the right allocation, but I believe it will not easily exceed this percentage as it is a very volatile market (but which has also given very good returns).

See you soon!

June

June Investment

Unrealized gain/loss Month: € 3,414

Unrealized gain/loss Total: € 16,775

Total money invested € 101,440

Unrealized gain/loss in percentage: 16.54%

FI Date: 01/09/2209

June Comment

I didn't follow the market much this month and I only realized that I had earned €3000 when I filled out the report.

I don't have much to say about the month because not much happened!

Half Year Comment

Half the year is gone!

I promised myself to learn to evaluate quality companies well by the end of the year to better understand if the market is overvalued and how to behave accordingly --> keep liquidity(?)

Maybe I will open a stock portfolio in the future with a small percentage of the total portfolio (1%) to see if my theories work.

Yes, I know the market is efficient based on the information that exists at that moment. However, it is also true that the market often exaggerates irrationally when it is too euphoric or too depressed. Let's see if I can find some depressed stocks to resurrect.

July

July Investment

Unrealized gain/loss Month: € -276

Unrealized gain/loss Total: € 16,499

Total money invested € 105,346

Unrealized gain/loss in percentage: 15.66%

FI Date: 01/07/2164

July Comment

The month has shown signs of decline in the last period.

Are we close to a significant market correction?

In any case I am not too worried about it.

This month I have also started to analyze individual quality companies, but I am not yet too comfortable to talk about them here, news will come in the future.

August

August Investment

Unrealized gain/loss Month: € +1204

Unrealized gain/loss Total: € 17.709

Total money invested € 109.946

Unrealized gain/loss in percentage: 16,11%

FI Date: 01/12/2200

August Comment

Same as last month.

I'm continuing my analysis of Quality companies, it seems there is potential, but I still don't understand why excellent companies should be little appreciated by the market (obvious irrationality?)

September

September Investment

Unrealized gain/loss Month: € +4.076,34

Unrealized gain/loss Total: € 21.785,47

Total money invested € 113.626,13

Unrealized gain/loss in percentage: 19,17%

FI Date: 01/12/2135

September Comment

Excellent month!

Market fluctuations can now yield more from my investments.

I finished analyzing Quality companies, a very nice investment approach which however does not fully satisfy me. I continue to see critical issues and I believe that markets always move on expectations as well as company data

October

October Investment

Unrealized gain/loss Month: € + 3.844,72

Unrealized gain/loss Total: € 25.630,19

Total money invested € 118.232,24

Unrealized gain/loss in percentage: 21,68%

FI Date: 01/12/2106

October Comment

Another great month!

I'm studying momentum to see how it behaves in different market situations. It seems to be doing better than the market.

November

November Investment

Unrealized gain/loss Month: € + 6.373,20

Unrealized gain/loss Total: € 32.003,39

Total money invested € 123.757,66

Unrealized gain/loss in percentage: 25,86%

FI Date: 01/12/2084

November Comment

Third month in a row with great returns!

I'm noticing that momentum investing is very much in line with my philosophy.

The price doesn't go up all at once, but it adapts to the expectations of investors. Including irrational expectations. I'm learning a lot about how it works.

December

December Investment

Unrealized gain/loss Month: € - 2.108,25

Unrealized gain/loss Total: € 29.895,14

Total money invested € 128.358,64

Unrealized gain/loss in percentage: 23,29%

FI Date: 01/6/2277

December Comment

Beginning of the reversal?

Possible, but I don't think so.

In the meantime I've studied momentum investing better and created a strategy that I'm backtesting to see if it works.