When you start taking your investments seriously, one of the first questions that pops up is: “How do I track everything in one place without losing my mind—or my returns?” After testing several apps and tools over the years, I came across Portfolio Performance some years ago, and I have to say, it left me with mixed but mostly positive impressions.

In this review, I’ll walk you through the strengths, limitations, and my personal opinion after using it consistently for several months.

What is Portfolio Performance?

Portfolio Performance (PP) is a free, open-source software designed to help you monitor, analyze, and evaluate your investment portfolio over time. It’s especially popular among European investors but works globally as long as you have access to accurate price data.

It supports tracking for:

✔️ Stocks

✔️ ETFs

✔️ Bonds

✔️ Mutual funds

✔️ Cryptocurrencies

✔️ Even cash positions and deposits

Unlike typical broker apps, PP offers a holistic view of your investments, combining performance analytics, dividends, transaction history, and detailed charts—all in one customizable interface.

Main Features That Stand Out

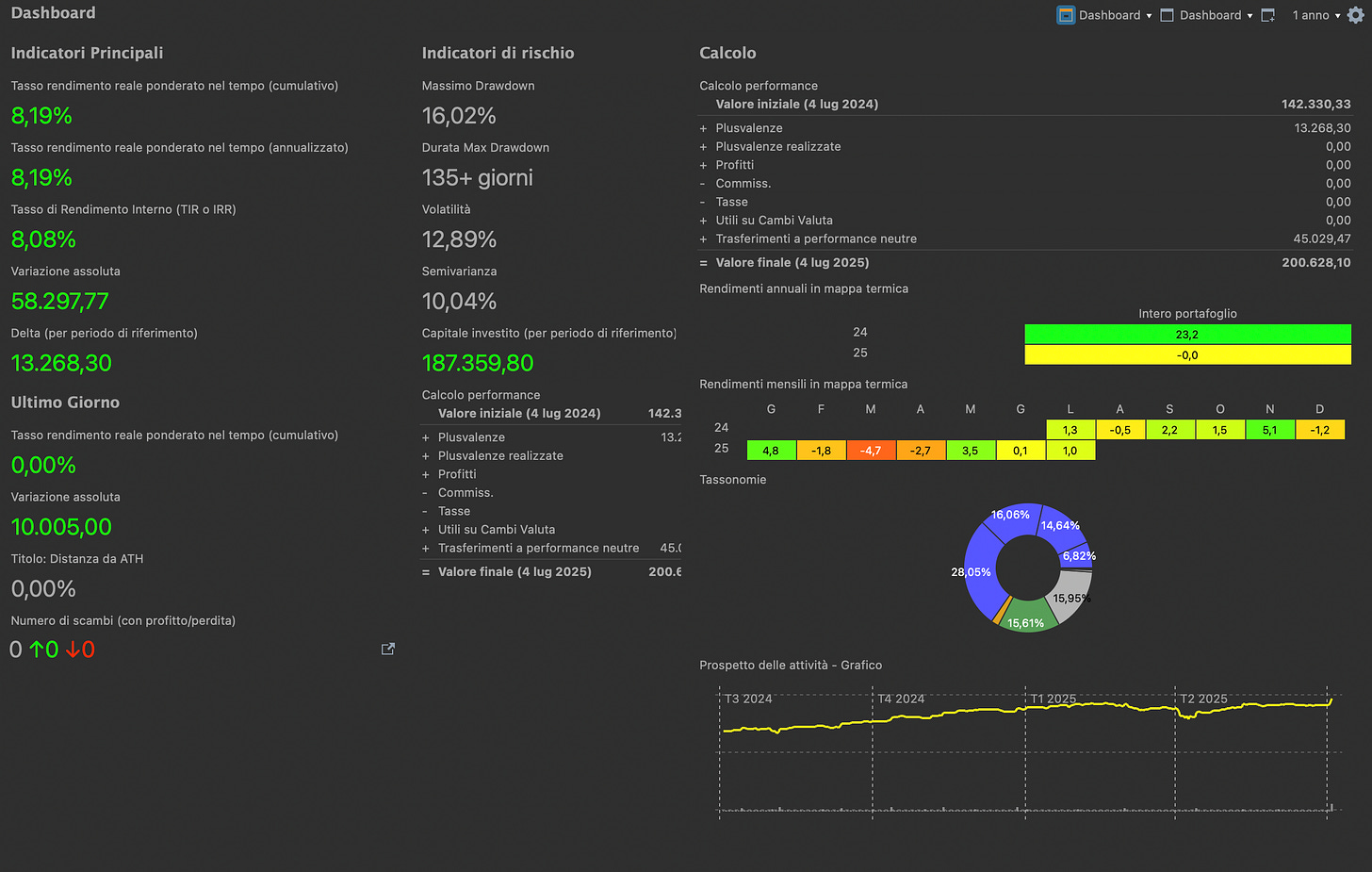

1. True Performance Calculation:

PP doesn’t just show portfolio value; it calculates Time-Weighted Return (TWR) and Internal Rate of Return (IRR), offering a clear picture of your portfolio’s real performance, independent of cash inflows or outflows.

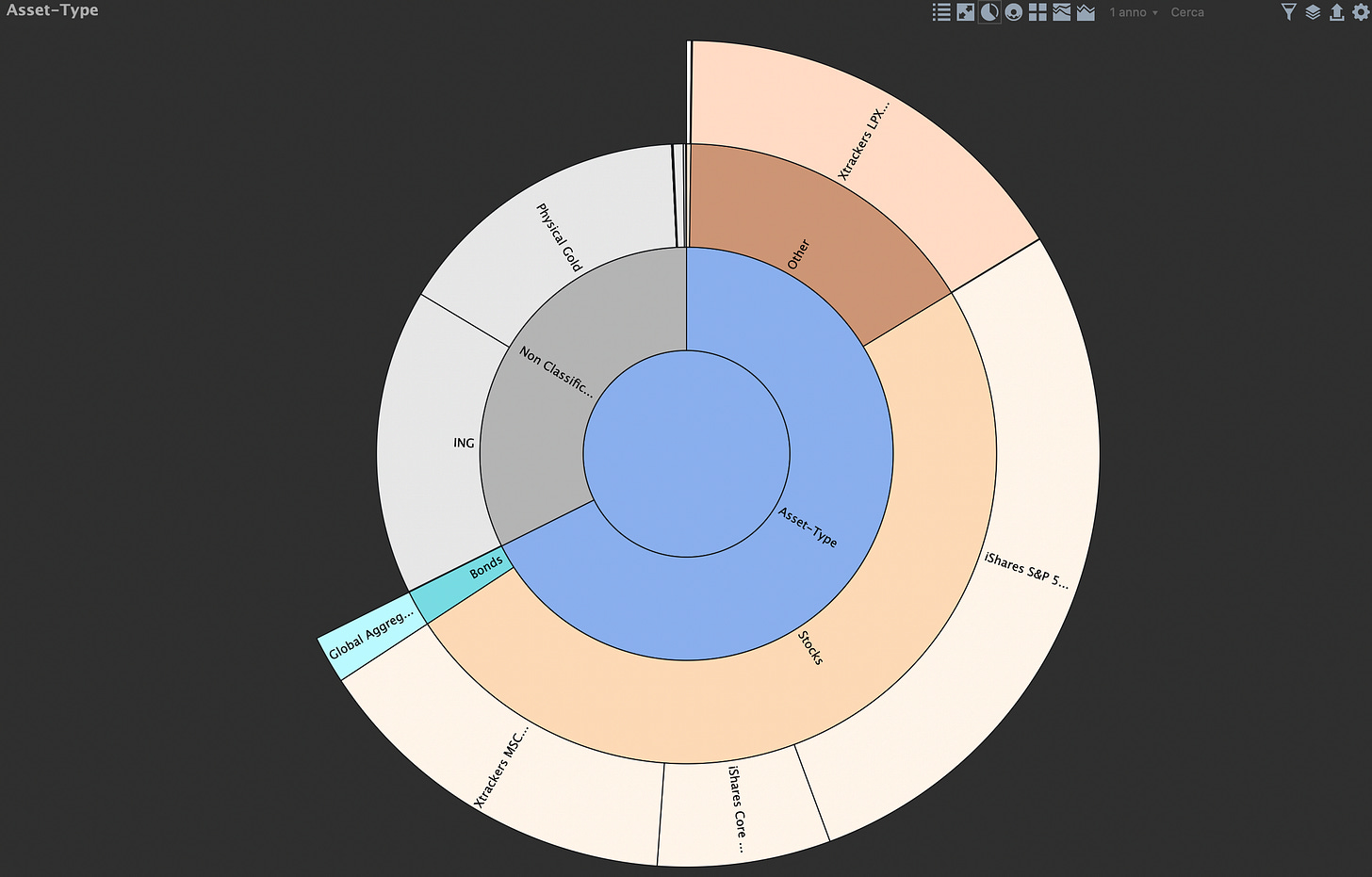

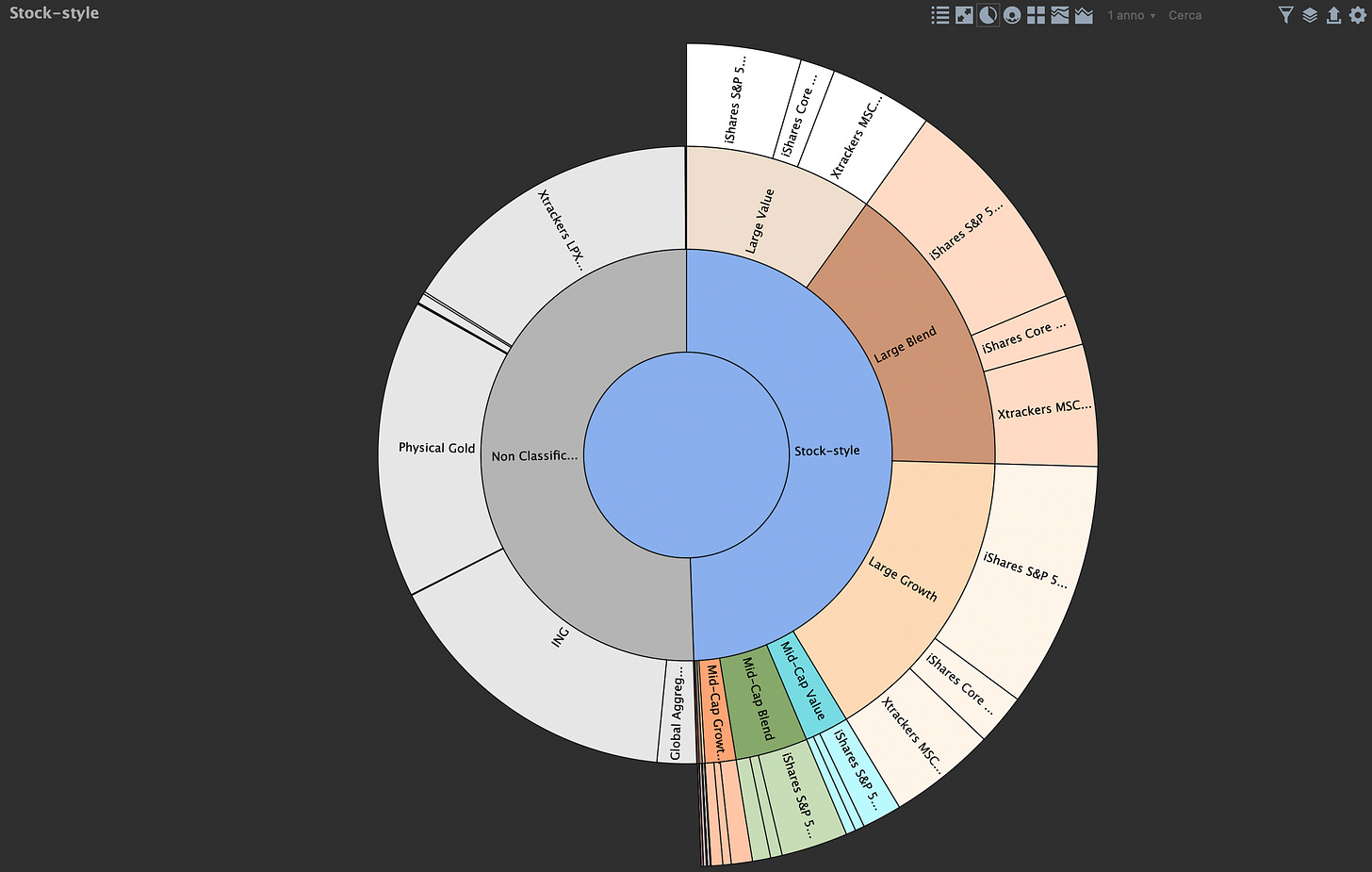

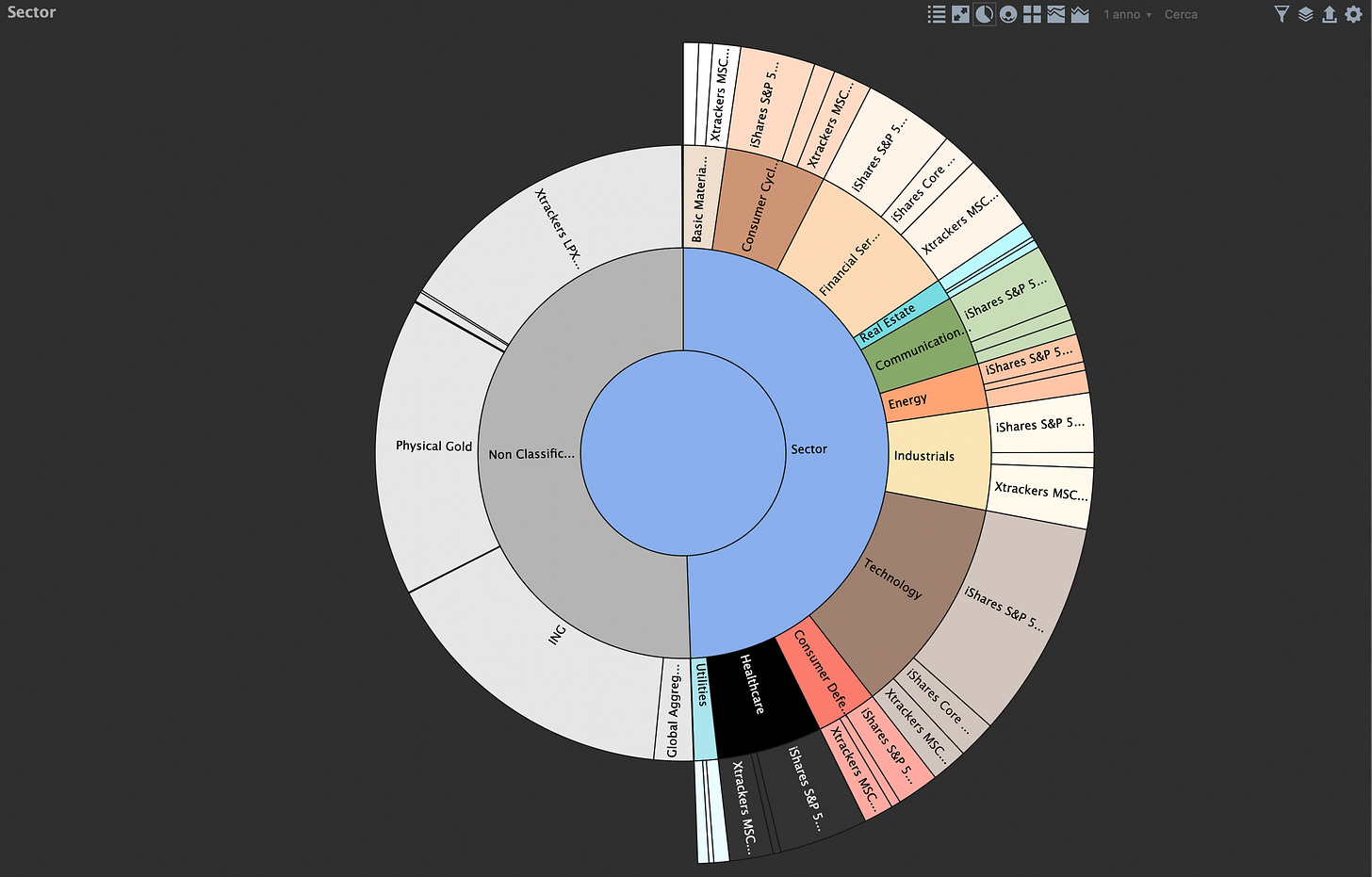

2. Extensive Customization:

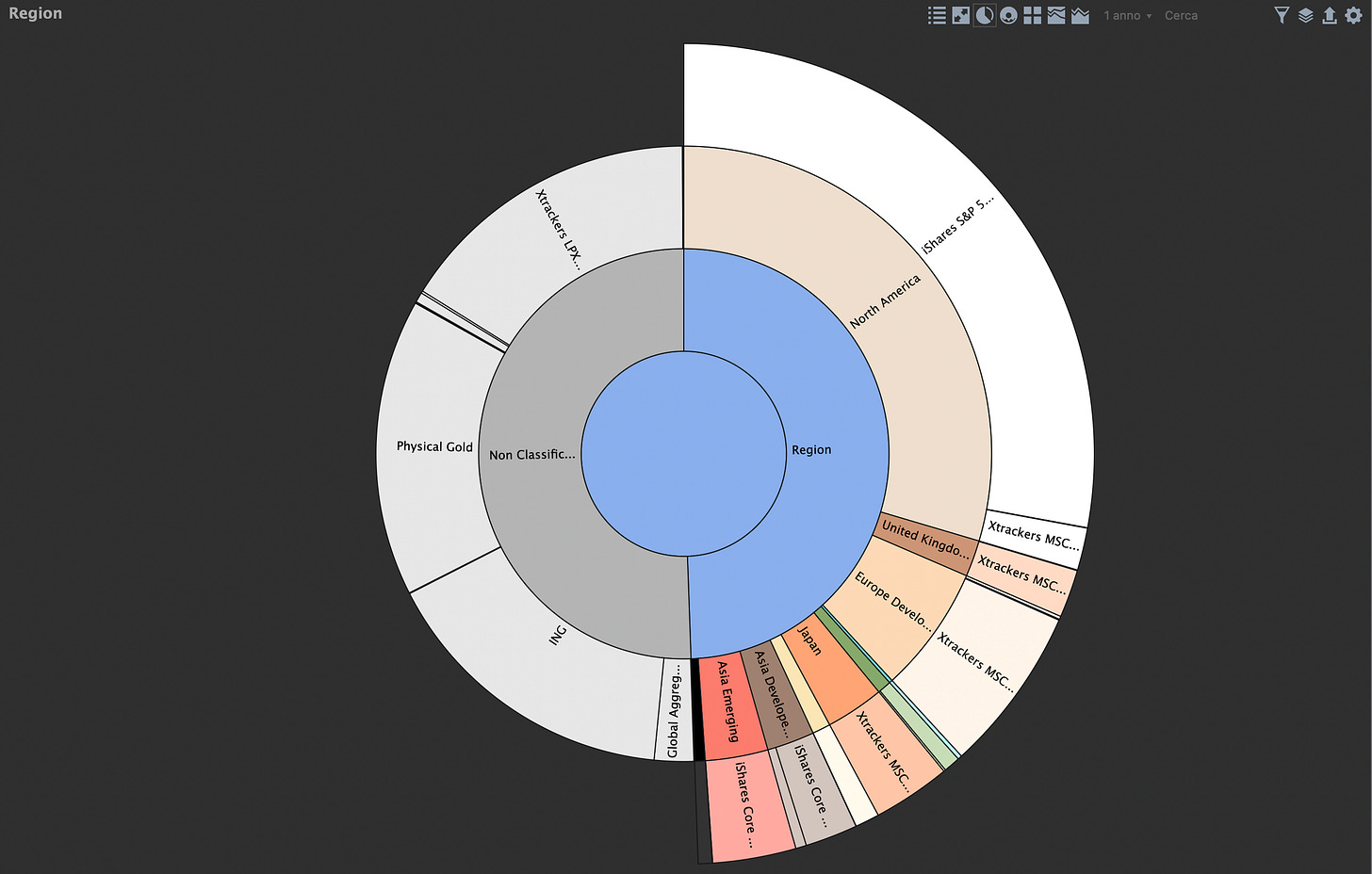

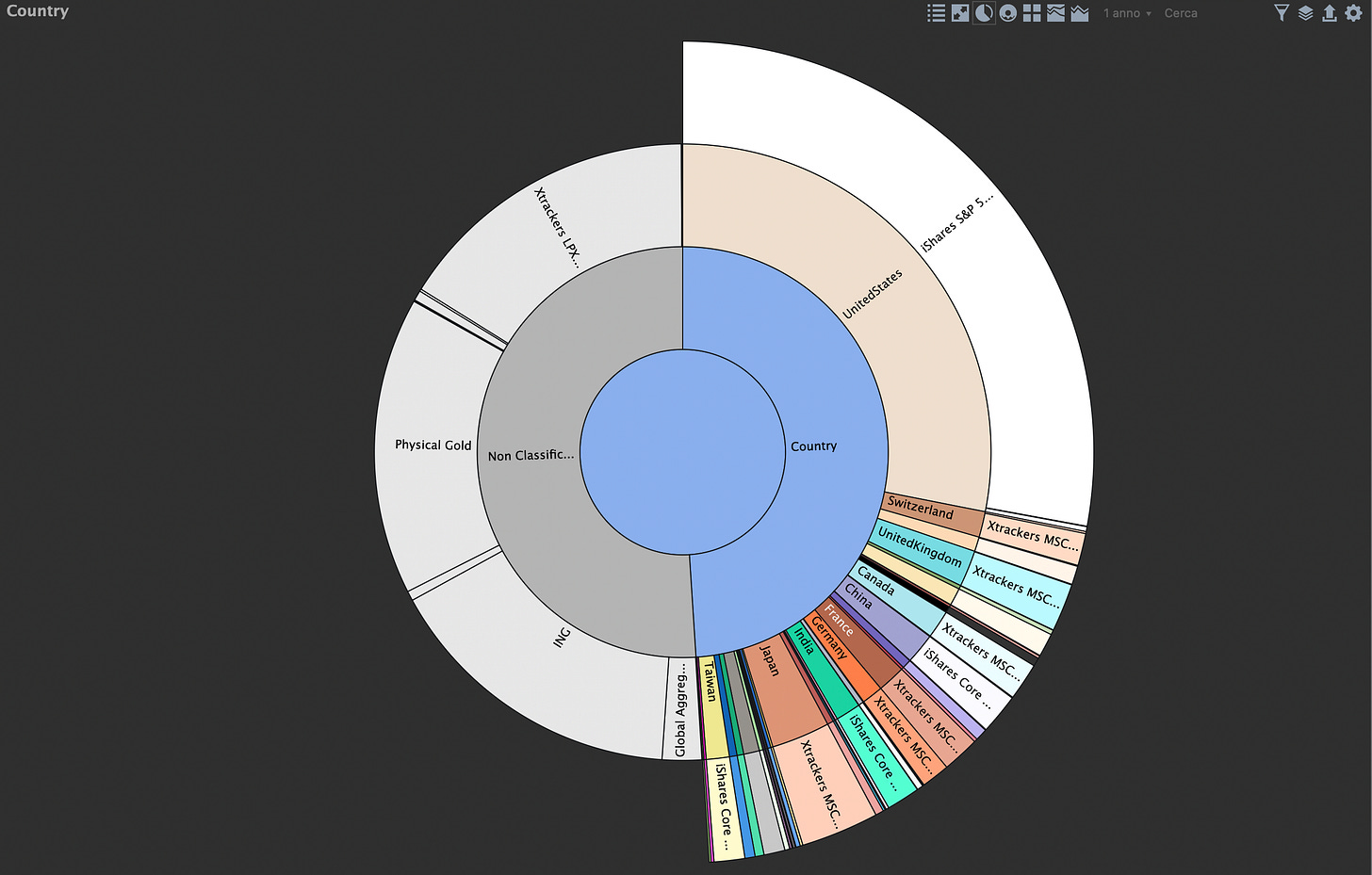

You can manually input every transaction, dividend, fee, or tax. Yes, it’s work, but the result is full control. You also choose how to group assets by type, region, sector, or your custom logic. Not everytime it can categorize all the assets (ING is my €35,000 liquid money bank account so no classification, and it has also some problems with Gold and Private Equity ETF).

Here are some examples:

3. Historical Data Import:

You can import data from CSV files, brokers, or external sources to retroactively build your portfolio history. Price updates can be automated via Yahoo Finance or other APIs.

4. Dividend and Cashflow Tracking:

One of the best features for income-focused investors is precise tracking of dividends, interest payments, and other cashflows—down to the cent.

The Downsides – Let’s Keep It Real

While PP offers impressive functionality, it comes with trade-offs:

Manual Data Entry:

If you expect an “automatic sync” with your broker, think twice. Most data entry is manual or semi-automated through CSV or PDFs. For me, this wasn’t a dealbreaker, but it can feel tedious, especially with frequent trades.

Steep Learning Curve:

It’s not the most user-friendly at first glance. Setting up your portfolio, understanding TWR vs. IRR, configuring imports—these require patience and a bit of financial literacy.

Mobile Access – A Step Forward, But with Limitations:

Portfolio Performance recently introduced a mobile app, addressing one of its historical weaknesses. However, it’s important to note that the mobile app isn’t yet designed for full portfolio management. You can’t create a portfolio from scratch on mobile — the app only allows you to view and track an existing file.

A smart approach? Set up your portfolio on the desktop version, save the file to a cloud service (like Google Drive, Dropbox, or iCloud), and access it on your mobile device whenever you’re on the go. It’s a great improvement for quick checks and monitoring, but serious editing and analysis still require the desktop version.

Occasional Bugs:

As an open-source project, you may run into minor bugs or quirks. Fortunately, the active community and developers usually address these quickly.

My Personal Take

Overall, Portfolio Performance is one of the most robust free tools for investors who want detailed control and visibility. It shines for those managing multiple asset classes or long-term portfolios with dividends.

It’s not designed for “lazy” investors who want plug-and-play apps. But for data-driven individuals who enjoy analyzing their investments—and don’t mind a bit of setup—it’s a fantastic solution.

Personally, I appreciate that PP is:

✔️ Private (your data stays local)

✔️ Customizable

✔️ Financially precise

✔️ Not tied to any commercial broker

That said, I wouldn’t recommend it to complete beginners. If you’re just getting started, a basic broker app is enough. But if you’ve reached the point where you want to track net worth, optimize performance, and fully understand your returns, PP becomes an indispensable tool.

Final Verdict:

Pros:

✅ Completely free and open-source

✅ Powerful analytics and reporting

✅ Excellent for dividend and cashflow tracking

✅ Total control over data

Cons:

⛔ Manual setup and maintenance

⛔ Steeper learning curve

⛔ Mobile app complex

Ideal for: Serious investors, dividend trackers and anyone seeking transparency beyond broker dashboards.

Not ideal for: Total beginners or those wanting a fully automated, mobile-first experience.

Would I keep using it? Absolutely.

As someone who likes understanding the full picture, Portfolio Performance gives me the confidence, clarity, and detailed data I need to stay aligned with my financial goals. That said, I also like to complement it with my own custom-built Excel file, wher I personally track income, expenses, investments, key metrics, projections, and personal notes in a more tailored format.

For me, the combination of Portfolio Performance’s deep analytics and the flexibility of Excel creates the ideal setup — structured, insightful, and fully adapted to my needs.

If you want to try Portfolio Performance yourself, you can download it for free here:

👉 https://www.portfolio-performance.info/en/

It works on Windows, macOS, and Linux, and now, with the new mobile app, you can also monitor your portfolio on the go — provided you save your file to the cloud and access it from there.