When you invest, you’re not just allocating money — you’re committing to a relationship with uncertainty. How much volatility you can accept without abandoning your strategy or selling at the worst moment is determined by your risk tolerance. Understanding this psychological and financial trait is one of the most important steps toward building a portfolio you can stick with during both good markets and rough patches.

What Does “Risk Tolerance” Really Mean?

Risk tolerance is the emotional and psychological comfort level an investor has with the ups and downs in the value of their portfolio. It’s different from risk capacity, which is an objective measure tied to finances and goals. Instead, risk tolerance is subjective: it reflects how much fluctuation you can personally endure before it impacts your decisions. One investor might shrug off a 15% drop; another might panic and sell if their portfolio loses 5%.

Historically, risk tolerance wasn’t part of formal financial planning until probability theory developed ways to think about uncertain outcomes. Today, it’s understood as a key driver of investment choices — because markets inherently involve volatility, and higher expected returns often come with larger swings in value.

The Two Sides: Ability vs. Willingness to Take Risk

Understanding risk tolerance starts with separating it into two components:

Ability to take risk: This depends on objective factors like your financial situation, income stability, investment time horizon, and overall wealth. Someone with a long time horizon and steady cash flow can afford to take more risk because downturns have time to recover.

Willingness to take risk: This is your emotional reaction to uncertainty. Some people may have the financial ability to take risk but feel uncomfortable watching their portfolio swing wildly. Others may emotionally tolerate volatility but lack the financial cushion to recover from losses without distress. (Forbes)

The strongest investment strategies align both ability and willingness. If either is out of sync — for example, if you have high willingness but low ability — you might make decisions driven by fear rather than logic.

Why Risk Tolerance Matters for Your Strategy

Your risk tolerance influences nearly every aspect of your investment plan:

Asset allocation: A higher tolerance generally supports a larger allocation to equities, which are volatile but have higher expected returns over long periods. Lower tolerance often favors bonds or other stable assets that provide capital preservation but lower long‑term growth. (Bankrate)

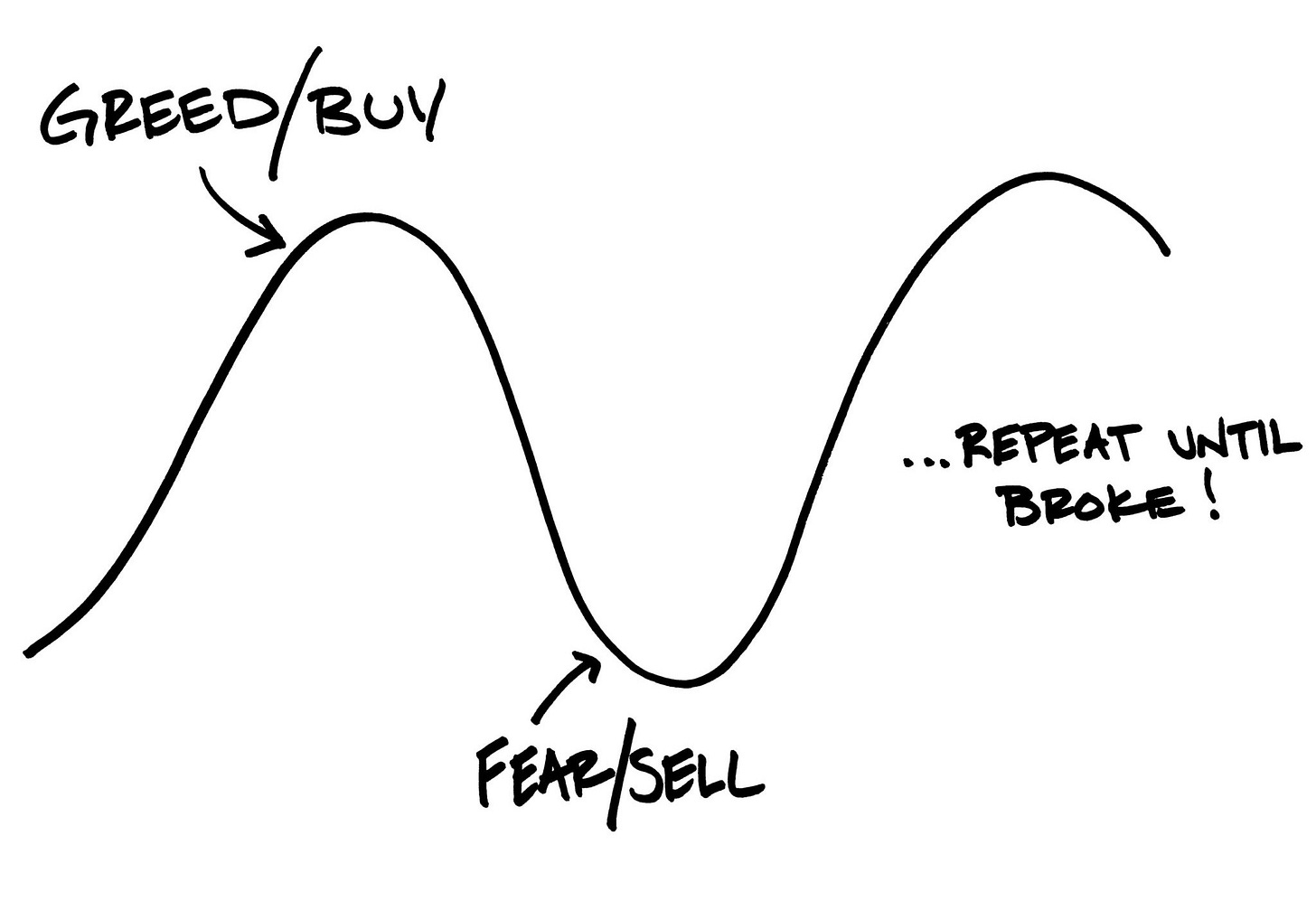

Portfolio resilience: When markets fall, your reaction matters. Investors who understand their tolerance are less likely to make emotional decisions like selling at the bottom out of panic.

Behavior under stress: Defined tolerance helps you avoid common behavioral pitfalls — reacting to short‑term noise instead of sticking with the plan rooted in your long‑term goals. Research shows that many investors only discover their true risk tolerance when markets decline, not when they’re rising. (Forbes)

How Risk Tolerance Shows Up in Real Life

Consider two investors with similar portfolios at the start of a market downturn:

Investor A watches a 20% drop and feels fine, staying invested or even buying more — trusting long‑term outcomes.

Investor B becomes anxious, sells most holdings, and moves to cash, locking in losses and missing the rebound.

Both may have theoretical tolerance on paper, but their emotional response to volatility tells a different story. Knowing this ahead of time means structuring a portfolio you can live with through uncertainty.

Practical Ways to Understand Your Risk Tolerance

Here are steps you can take to assess and apply your risk tolerance:

Reflect on past reactions to volatility: Think about your emotional response during past market swings. Would you hold or sell?

Consider your life context: Big life changes — starting a family, changing jobs, planning large purchases — can shift your tolerance over time. (Forbes)

Be honest with yourself: Risk tolerance isn’t a badge of courage. Being realistic about your comfort with losses helps avoid decisions that hurt your long‑term wealth.

Align with strategy: Use tolerance as a guide for constructing an allocation that matches both your psychological comfort and financial goals.

Revisit regularly: Tolerance isn’t static. It can change as your circumstances and experience evolve — so revisit periodically.

Common Mistakes Around Risk Tolerance

One of the biggest mistakes is relying solely on generic risk questionnaires — they often don’t capture the real emotional response investors have during market stress. Quantitative tools are useful, but a deeper conversation about goals, fears, and scenarios usually reveals much more about someone’s true tolerance.

Another error is ignoring risk tolerance altogether: some investors chase high returns without realizing that they can’t tolerate the fluctuations required to get there. This mismatch often leads to poor timing decisions and selling at market lows — the exact opposite of long‑term investing success.

Risk Tolerance & Your Investment Identity

Your relationship with risk reveals a lot about your investment identity — it exposes how you balance the desire for growth with the fear of loss. A portfolio isn’t just a strategy; it’s a reflection of both your financial goals and psychological makeup. Understanding why you make certain choices can help you build not just a better portfolio, but a more resilient one.