This page will track my progress towards financial independence with a practical progress bar and yearly investment updates.

Progress Bar Financial Independence

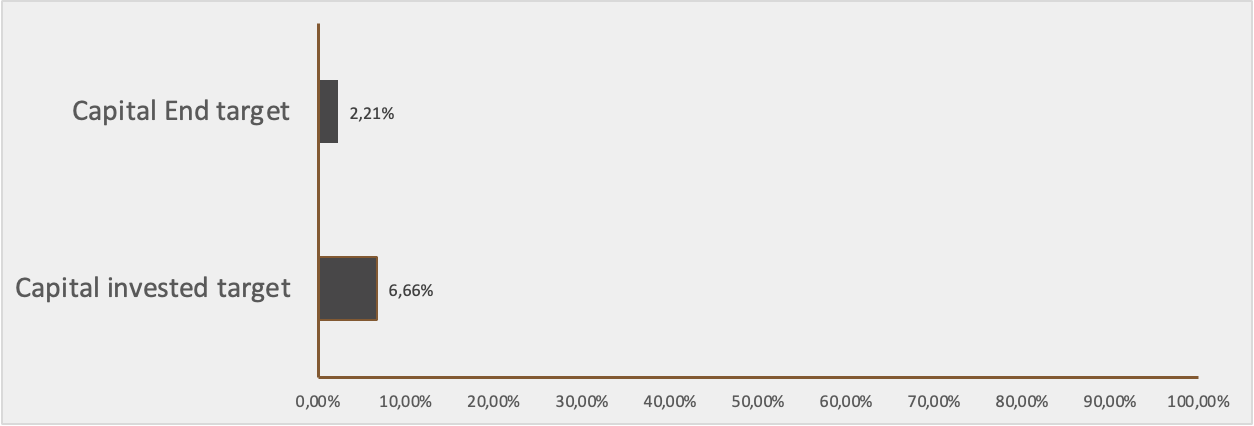

The bars below represent my current financial situation compared to the values I aim to achieve for financial independence. The first bar shows my current money compared to the target value by the end of my journey. The second bar represents the money I have actually invested compared to my total investment goal.

Goals for the end of the year (December 2026):

- Reach 8% of my Capital invested target

- Reach 3% of my Capital end target

Goals for the end of the year (December 2025):

- Reach 6.5% of my Capital invested target ✅

- Reach 2% of my Capital end target ✅

Goals for the end of the year (December 2024):

- Reach 6% of my Capital invested target ❌

- Reach 1.5% of my Capital end target ✅

Goals for the end of the year (December 2023):

- Reached 3% of my Capital invested target ✅

- Reached 1% of my Capital end target ❌

Asset Allocation Over the Years

I'm not proud of my changes, but I hope that tracking them will help me avoid similar mistakes in the future.

World (diversified) + Gold (May 2024 --> Today):

I decided to break it down to have better control over the geographical balance within the old ACWI, and I also added a small portion of bonds.

World + Gold (September 2023 --> April 2024):

After nearly changing portfolios again to improve returns or reduce risk, I decided that time spent trying to beat the market wasn't worth it compared to improving my skills at work to earn more money. I was also becoming obsessed with predicting the future. I plan to create a system to adapt my portfolio according to market conditions, possibly using CAPE.

US Sectorial Strategy + Tips (May 2023 - August 2023)

I removed world quality because, according to my analysis, adding Consumer Staples would decrease portfolio risk.

US Sectorial Strategy + World Quality + Tips (February 2022 - March 2023)

Similar to losing asset allocation, but I added TIPS (Treasury Inflation Protected Securities) for diversification.

US Sectorial Strategy + World Quality (July 2022 - January 2023)

I created this portfolio because I believe some countries, due to their political or social mentality, have the potential for higher stock market returns. One of these is America. Also, I still believe certain sectors can provide better returns under similar market conditions. IT, Health Care, and Utilities are my top picks. Other financial instruments serve to balance the portfolio regarding different market conditions.

Wealthy's Goals (By Years)

Hey there!

Welcome to my little corner of the internet. I'm Wealthy, and this right here is where I put down my financial goals and dreams. Think of it as my personal finance diary, and I'm stoked that you're here to check it out.

2026 Wealthy’s Goals

1: Retirement Savings

Reach the € 200k invested planned for the last 2 years. (Gains are not contemplated here because they are beyond my powers).

2: Investment Portfolio

Mantain an asset allocation that gives me peace, accept some changes, but they need to have a strong belief behind.

3: Charitable Giving

Contributing to causes I’m passionate about will allow me to give back to the community and make a difference. (< 200€/year)

4: Work Improvement

Try moving to Switzerland.

5: Lifestyle Improvement

Try to spend less for what I use everyday to save more

6: Continue the blog

Even if this blog is read by few people I would like to continue to keep it alive. It’s a great outlet for me and I hope I can help someone with my posts.

2025 Wealthy's Goals

1: Retirement Savings

Reach the € 200k invested planned for the last year. (Gains are not contemplated here because they are beyond my powers). ❌

2: Investment Portfolio

Mantain an asset allocation that gives me peace, accept some changes, but they need to have a strong belief behind. ✅

3: Charitable Giving

Contributing to causes I'm passionate about will allow me to give back to the community and make a difference. (< 200€/year) ✅

4: Work Improvement

Make a career leap to improve my salary. (Changed job and landed in Amazon) ✅

5: Lifestyle Maintenance

Actually, I like my lifestyle, trying to do new experiences without increasing my spendings (moving to Paris increased my expenses and I find few solutions to downgrade it) ❌

6: Continue the blog

Even if this blog is read by few people I would like to continue to keep it alive. It's a great outlet for me and I hope I can help someone with my posts. ✅

2024 Wealthy's Goals

1: Retirement Savings

First Goal is to reach € 200k invested in the capital market. (Gains are not contemplated here because they are beyond my powers).❌

2: Investment Portfolio

I don't change my investment portfolio (ACWI + Gold) and neither % (ACWI 90% / Gold 10%). Even if some discrepancy (<5%) are accepted.❌

3: Charitable Giving

Contributing to causes I'm passionate about will allow me to give back to the community and make a difference. (<200€/year)✅

4: Work Improvement

Learn more and more and become a non-negligible resource for the company I work for.✅

5: Lifestyle Downgrade

Lastly, I believe in enjoying the present while planning for the future. I'm setting a goal to reward myself without lifestyle upgrades, but with finding new ways to enjoy life spending less. ✅

6: Continue the blog

Even if this blog is read by few people I would like to continue to keep it alive. It's a great outlet for me and I hope I can help someone with my posts.✅