We hear about Dollar Cost Averaging (DCA) everywhere — as a disciplined, reliable method for building wealth over time. And rightly so. Whether you’re just starting out or managing an existing lump sum, DCA can help smooth the emotional ride of investing.

Yet despite its popularity, DCA remains one of the most misunderstood strategies out there. Investors, and even some financial advisors, continue to spread misconceptions that can confuse newcomers and lead to hesitation.

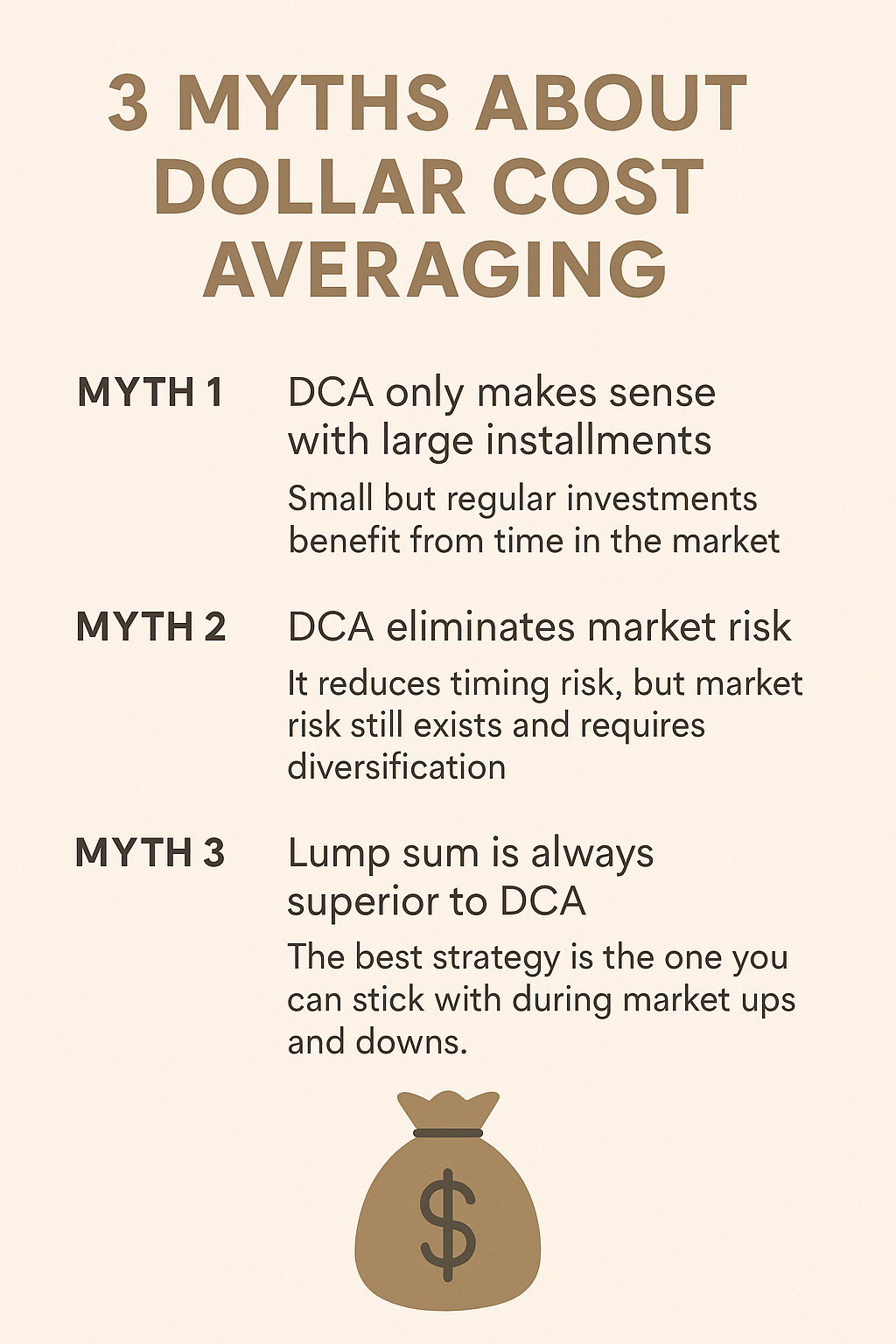

Today, let’s clear the air. I’ll walk you through the 3 most common false beliefs about DCA — and why they don’t hold up when you look closer.

Myth 1: “DCA Only Makes Sense With Large Installments”

Many believe that DCA is only useful if you can invest €1,000 or more at a time. The reasoning? Transaction costs.

Imagine you invest €100 per month with €3 of fees — that’s 3% “lost” on each installment, which sounds alarming. Some advisors even suggest waiting months to accumulate a bigger amount before investing.

But here’s the thing: focusing only on the percentage is misleading. In absolute terms, €3 is €3 — whether it’s on €100 or €1,000. We overreact to percentages because we instinctively link them to large sums, forgetting that small, recurring fees often pale in comparison to missed market growth.

More importantly, delaying your entry to “save” on fees often means your money sits idle, not working for you. Markets don’t wait, and missing months of potential growth can impact your long-term results more than small, recurring costs.

I’ve personally tested this with real data, comparing:

✔️ Monthly DCA of €100 from day one

✔️ Quarterly DCA of €300 (waiting to accumulate more)

✔️ Annual DCA of €1,200 (maximum delay)

Consistently, the investor who started earlier — even with small amounts and higher percentage fees — came out ahead, simply because time in the market matters more than micro-optimizing fees.

Myth 2: “DCA Eliminates Market Risk”

Let me be clear: DCA is a great tool to reduce timing risk, but it doesn’t erase market risk entirely.

Yes, spreading your purchases over time smooths your average entry price, but:

⚠️ DCA doesn’t protect you from market downturns — your portfolio value will still fluctuate

⚠️ If you invest in low-quality assets, DCA won’t fix a bad decision

⚠️ Emotional discipline is still required — many investors panic during volatility, regardless of the strategy

DCA helps manage uncertainty, but it’s not a shortcut to guaranteed returns. You still need diversification, research, and a long-term mindset.

Myth 3: “Lump Sum Is Always Superior to DCA”

The academic studies are clear: if markets trend upward (as they historically do), investing everything upfront often produces higher long-term returns compared to DCA.

But here’s the inconvenient truth most people overlook: theory isn’t reality.

In practice, most investors struggle to deploy large sums all at once. The fear of bad timing, market volatility, and emotional stress often lead to hesitation, poor decisions, or abandoning the plan altogether.

DCA, on the other hand, introduces:

✔️ A structured, automated approach

✔️ Reduced anxiety about market timing

✔️ Increased consistency in investing behavior

It’s not about maximizing theoretical returns — it’s about maximizing your ability to stay invested, consistently, for years.

The best strategy? The one you can stick with, through market ups and downs.

If you want to learn more about differences between Cost Averaging and Lump Sum, I made this post some years ago.

Why I Personally Use DCA

For me, DCA isn’t about chasing the highest return on paper — it’s about building a solid, stress-free foundation for long-term wealth. I integrate DCA into my broader financial plan, alongside lump-sum investments and other methods like Value Averaging, based on my personal goals and market conditions.

What matters most? Consistency, emotional control, and keeping your money working — even with small amounts.

Forget the myths. Start where you are. Focus on building habits. The rest will follow.