Market crashes don’t just test portfolios.

They test investors.

And historically, most damage during crashes is not caused by markets themselves, but by investor behavior: panic selling, timing errors, emotional decisions made under stress.

This article is not about staying calm or believing blindly in the long term.

It is about building a behavioral survival kit — a framework designed to prevent irreversible mistakes when markets stop behaving normally.

Panic Selling: Why It Feels Rational (and Isn’t)

During a crash, selling feels logical. Prices fall fast, uncertainty explodes, and fear activates the brain’s survival mode.

The problem is that panic selling usually occurs after most of the decline has already happened.

Crashes are asymmetric:

Fast and violent on the way down

Gradual and unpredictable on the way up

Selling in panic locks in losses and requires two perfect decisions to recover: selling near the bottom and re-entering before the rebound. Most investors fail at both.

Panic selling is not risk management.

It is risk crystallization.

Survival rule: if the investment thesis hasn’t changed, price alone is not a reason to sell.

Timing Errors: The Silent Destroyers

Timing errors don’t feel dramatic, but they quietly erode long-term outcomes.

They usually appear as:

Waiting for clarity while markets recover in silence

Re-entering too late because fear remains after prices rise

Gaining false confidence after one correct timing decision

Markets do not reward hesitation. They punish indecision disguised as prudence.

Survival rule: any strategy that requires precise timing is fragile by design.

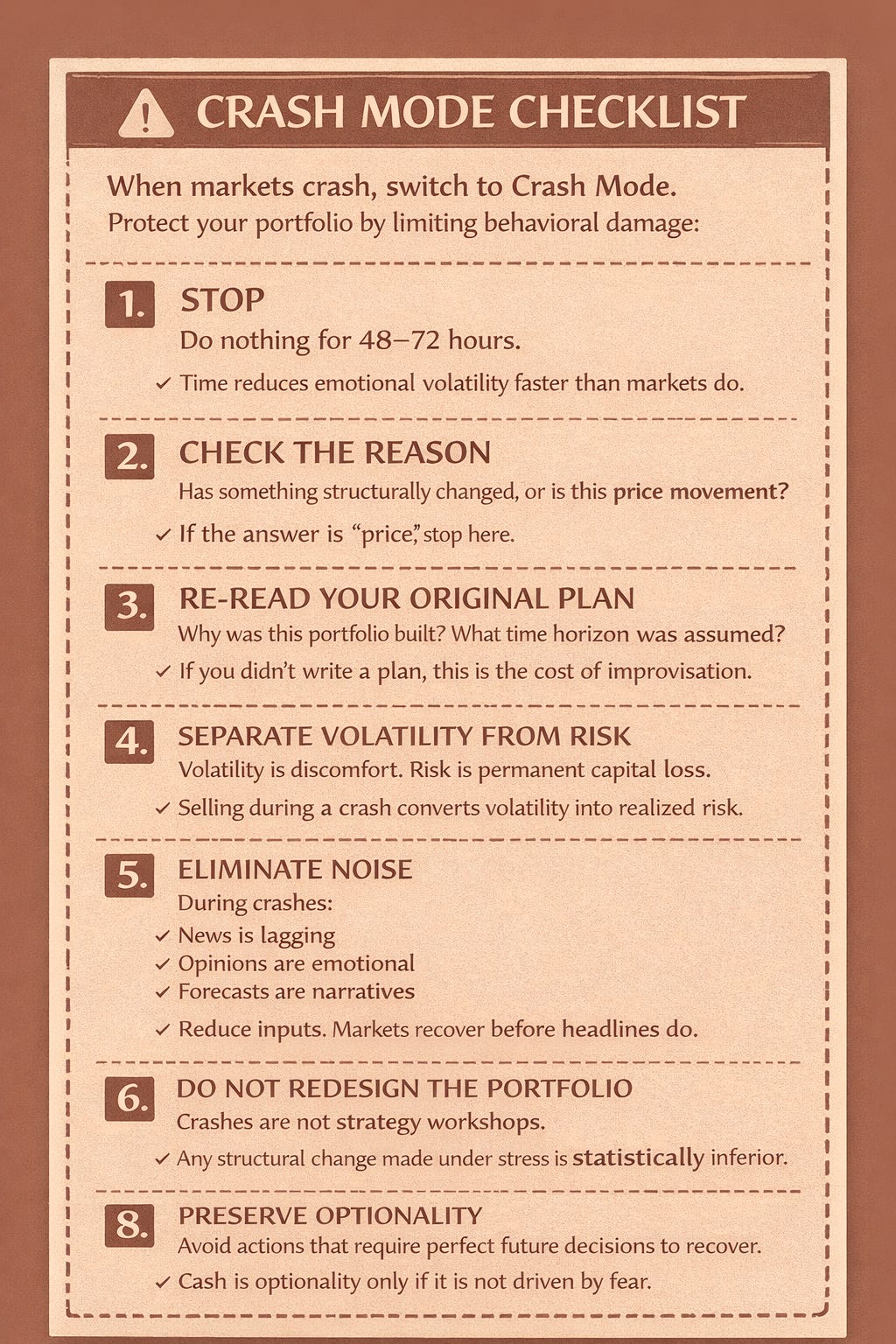

Crash Mode Checklist (Read Before Doing Anything)

When markets crash, switch to Crash Mode.

This checklist is not about optimizing — it’s about damage control.

1. Stop

Do nothing for 48–72 hours.

No trades, no reallocations, no “small adjustments.”

Time reduces emotional volatility faster than markets do.

2. Check the reason

Ask a single question:

Has something structurally changed, or is this price movement?

If the answer is “price,” stop here.

3. Re-read your original plan

Why was this portfolio built?

What time horizon was assumed?

What risks were explicitly accepted?

If you didn’t write a plan, this is the cost of improvisation.

4. Separate volatility from risk

Volatility is discomfort.

Risk is permanent capital loss.

Selling during a crash converts volatility into realized risk.

5. Eliminate noise

During crashes:

News is lagging

Opinions are emotional

Forecasts are narratives

Reduce inputs. Markets recover before headlines do.

6. Do not redesign the portfolio

Crashes are not strategy workshops.

Any structural change made under stress is statistically inferior.

7. Preserve optionality

Avoid actions that require perfect future decisions to recover.

Cash is optionality only if it is not driven by fear.

8. If in doubt, default to inaction

In investing, doing nothing is often an active decision — and frequently the correct one.

What Not to Do During Market Crashes

Some behaviors consistently destroy value:

Chasing “safety” after losses

Switching strategies mid-crisis

Anchoring to previous market highs

Equating market drops with economic collapse

Consuming financial media as decision support

Crashes create the illusion that action equals control.

In reality, restraint is often the highest form of control.

The Real Objective During a Crash: Survival

The goal during a crash is not to be clever.

It is to avoid irreversible mistakes.

Markets recover.

Time compounds.

Behavioral errors don’t self-correct.

Survival means:

Staying invested if the plan remains valid

Avoiding forced decisions

Accepting emotional discomfort without acting on it

You don’t need conviction.

You need consistency.

Final Thought: Crashes Are Behavioral Filters

Market crashes don’t reward prediction or bravery.

They reward process.

They filter out investors who confuse movement with meaning, and discipline with passivity.

Long-term results are not built in moments of panic —

they are preserved by avoiding catastrophic errors when emotions are loudest.

The best investors are not the ones who act best during crashes, but the ones who do the least damage.