When it comes to investing, few concepts are as fundamental—and as misunderstood—as Asset Allocation. But what exactly is it? Why does every serious investor and financial advisor keep talking about diversification? And most importantly, how can understanding these principles help you grow your wealth while managing risk?

Let’s dive into the story of Asset Allocation, its origins, and why it remains at the heart of modern investment strategies.

The Origins: Harry Markowitz and the Birth of Modern Portfolio Theory

In 1952, economist Harry Markowitz published his groundbreaking work titled “Portfolio Selection”, laying the foundation for what we now call Modern Portfolio Theory (MPT). Before Markowitz, investing was often about picking individual stocks based on expected returns or company fundamentals. Risk management? That was largely intuition and luck.

Markowitz introduced a revolutionary idea: stop focusing only on individual assets—look at how they interact together within a portfolio.

His insight? You can combine different financial instruments—even risky ones—in a way that reduces the overall risk, without necessarily sacrificing returns. This is the core of diversification.

Diversification: Reducing Risk Without Giving Up Returns

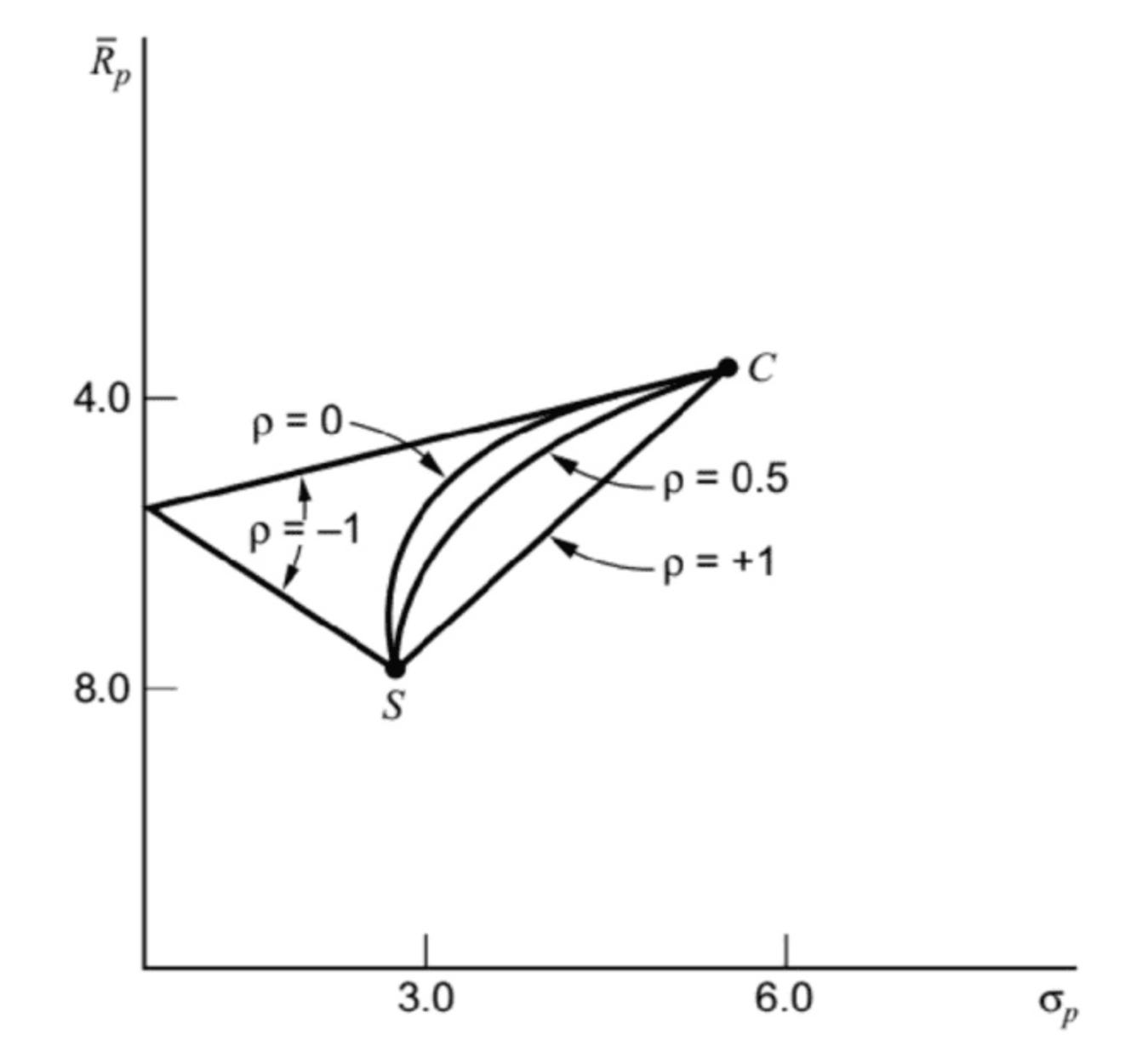

Markowitz mathematically demonstrated that by mixing assets with imperfectly correlated returns, investors could reduce the overall volatility (risk) of their portfolios. The key term here is correlation—how much two assets move together:

Perfect Positive Correlation (+1): The assets move together in the same direction. No diversification benefit.

Perfect Negative Correlation (−1): The assets move exactly in opposite directions. Maximum diversification benefit.

Zero Correlation (0): The assets move independently. Some diversification benefit.

Why Does This Matter?

Imagine two investments:

Asset A: Expected return of 8%, risk (volatility) of 3%

Asset B: Expected return of 14%, risk (volatility) of 6%

If these assets are perfectly correlated, combining them offers no reduction in risk. But if they’re uncorrelated—or better yet, negatively correlated—you can create a portfolio that has:

✔ Lower overall risk than either asset alone

✔ A return that sits between the returns of A and B

This is diversification in action.

It’s About the Whole, Not the Parts

Perhaps the most revolutionary idea from Markowitz is that the risk of a portfolio isn’t just the sum of individual risks. What matters is how the assets interact. Specifically, the overall risk depends on:

The individual asset risks (volatility)

The weights (how much of each asset you hold)

The correlations between assets

That’s why modern investors look beyond picking the “best stock” and instead focus on building the “best combination” of investments.

Efficient Portfolios and the Efficient Frontier

From these ideas came the concept of the Efficient Frontier—a set of optimal portfolios that offer:

The maximum expected return for a given level of risk

The minimum risk for a given expected return

Visualize it as a curve on a graph where risk is on the x-axis and return on the y-axis. Portfolios on this curve are “efficient,” meaning you can’t improve them without either:

Increasing risk for more return

Decreasing return for less risk

The right portfolio for you depends on your risk tolerance—how much uncertainty you’re comfortable with.

In the image below the Efficient Frontier is represented for different correlation values between the 2 assets. In the case of 𝜌 = -1 the Efficient Frontier is only the line between C and the Y Axis. The segment Y axis - S is inefficient.

Real-World Application: Diversification Isn’t Perfect, But It Works

In theory, perfect negative correlation between assets would allow you to eliminate risk entirely. In reality, this is rare. Most financial instruments have positive or mildly negative correlations, but diversification still works:

You reduce risk

You stabilize returns over time

You protect yourself from the poor performance of individual assets

And while you can’t eliminate all risk (nor should you try—higher returns often come with some risk), thoughtful Asset Allocation based on diversification remains the best tool for building long-term wealth.

Final Thoughts: Asset Allocation as the Foundation of Investing

Markowitz’s work transformed investing from guesswork to a scientific, systematic approach. Today, Asset Allocation is at the core of investment strategies, from personal portfolios to institutional funds.

Whether you’re a beginner or a seasoned investor:

Diversify your portfolio

Understand the relationships between your investments

Align your risk with your personal goals and comfort level

The beauty of Asset Allocation is that it empowers you to manage risk, pursue returns, and build a resilient portfolio for the future.

In short: It’s not about finding the perfect stock—it’s about building the perfect portfolio

.