Diversification is one of the most fundamental principles of investing, yet it’s often misunderstood, oversimplified, or worse — ignored. The basic idea is simple: don’t put all your eggs in one basket. But in practice, smart diversification is both art and science — and how you implement it can make a significant difference in your long‑term investment outcomes.

What Diversification Really Means

At its core, diversification is risk management. Instead of concentrating your entire portfolio in one asset — for example, a single stock or a single sector — you spread your capital across a range of investments that don’t move in perfect sync. This helps smooth returns and limit losses when markets get volatile.

Imagine two investors:

Investor A puts everything into a single high‑growth tech stock.

Investor B invests the same amount across tech, bonds, commodities, and international equities.

If that tech stock rallies, Investor A may win big. But if it crashes — like Enron once did — the losses can be catastrophic. Investor B won’t capture all the upside, but the diversified portfolio buffers the blow, reducing the chance of severe drawdowns.

How Diversification Actually Reduces Risk

The real power of diversification comes from correlation — how different assets move relative to each other. When assets are not perfectly correlated, they don’t rise and fall together. That means when one part of your portfolio is struggling, another might be steady or gaining, which reduces overall volatility.

Here’s a simplified example:

Asset A (High‑growth equity): +30% in good markets, −20% in bad markets

Asset B (Stable utility): +5% in good markets, +2% in bad markets

If you invest only in A, your portfolio swings widely. If you split between A and B, overall volatility drops significantly — even if average returns are slightly lower.

This is the practical lesson behind the Modern Portfolio Theory (MPT) — formalized by Harry Markowitz — which shows that a diversified mix of assets can offer a better risk‑return profile than any single holding. MPT suggests that the whole portfolio matters more than its individual pieces.

Diversification Isn’t Just About Holding More Assets

There’s a common misconception that simply owning more assets equals better diversification. But quantity doesn’t guarantee quality — what matters is how those assets behave relative to each other.

Here are the dimensions of smart diversification:

1. Asset Class Diversification

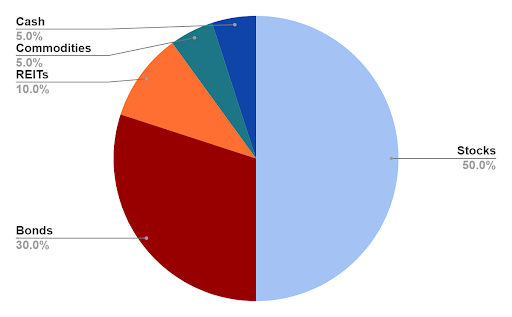

Mixing equities, bonds, real estate, commodities, and cash can smooth performance because these classes often respond differently to economic conditions. (

2. Geographic Diversification

Investing only in your home market can expose you to country‑specific risks. A global approach spreads exposure across different economic cycles and growth regions.

3. Sector Diversification

Within equities, avoid overweighting a single industry. Technology, healthcare, consumer goods, and financials often move differently depending on economic trends.

4. Time Diversification

Regular investing over time — such as through a PAC or DCA — helps mitigate the risk of investing a lump sum at the wrong moment.

5. Strategy Diversification (especially for advanced investors)

You can diversify not just by assets but by investment approach, blending long‑term buy‑and‑hold with factor‑based strategies or even alternative algorithms.

When Diversification Can Go Too Far

While diversification usually reduces risk, it’s not a free lunch. Over‑diversification — sometimes called diworsification — happens when you add so many assets that the incremental benefit disappears, but costs, complexity, and tracking effort increase.

Legendary investors like Peter Lynch and Charlie Munger have warned against blind diversification. Munger’s famous insight — “one good investment can be better than a hundred mediocre ones” — reminds us that conviction and understanding matter.

Warren Buffett also framed diversification as protection against ignorance: smart if you lack the time or expertise to choose winners, but unnecessary for those who truly understand their investments.

For most individual investors, however, diversification remains essential. Without it, a misstep in a single stock or market sector can wipe out years of progress.

Practical Rules for Better Diversification

Diversification doesn’t need to be complicated. Here are practical guidelines most investors can apply:

• The 5% Rule: No single investment should exceed ~5% of your portfolio — a simple heuristic to limit concentration risk.

• Use Broad Market Vehicles: ETFs and index funds inherently diversify across hundreds or thousands of securities, offering diversification with low cost and simplicity.

• Check Correlations: Avoid holdings that tend to move together — especially within equities — to truly spread risk.

• Rebalance Regularly: As markets move, so do your allocations. Rebalancing ensures you maintain your chosen diversification targets.

A Balanced View: Diversification and Goals

Diversification is not about maximizing short‑term returns. It’s about building resilience into your financial plan. In turbulent years, a well‑diversified portfolio won’t always lead the market — but it protects you from the worst drawdowns, improves the reliability of long‑term returns, and reduces emotional decision‑making under stress.

In essence, diversification is not just a strategy — it’s insurance for your peace of mind as an investor. For most people, it’s the backbone of prudent investing.