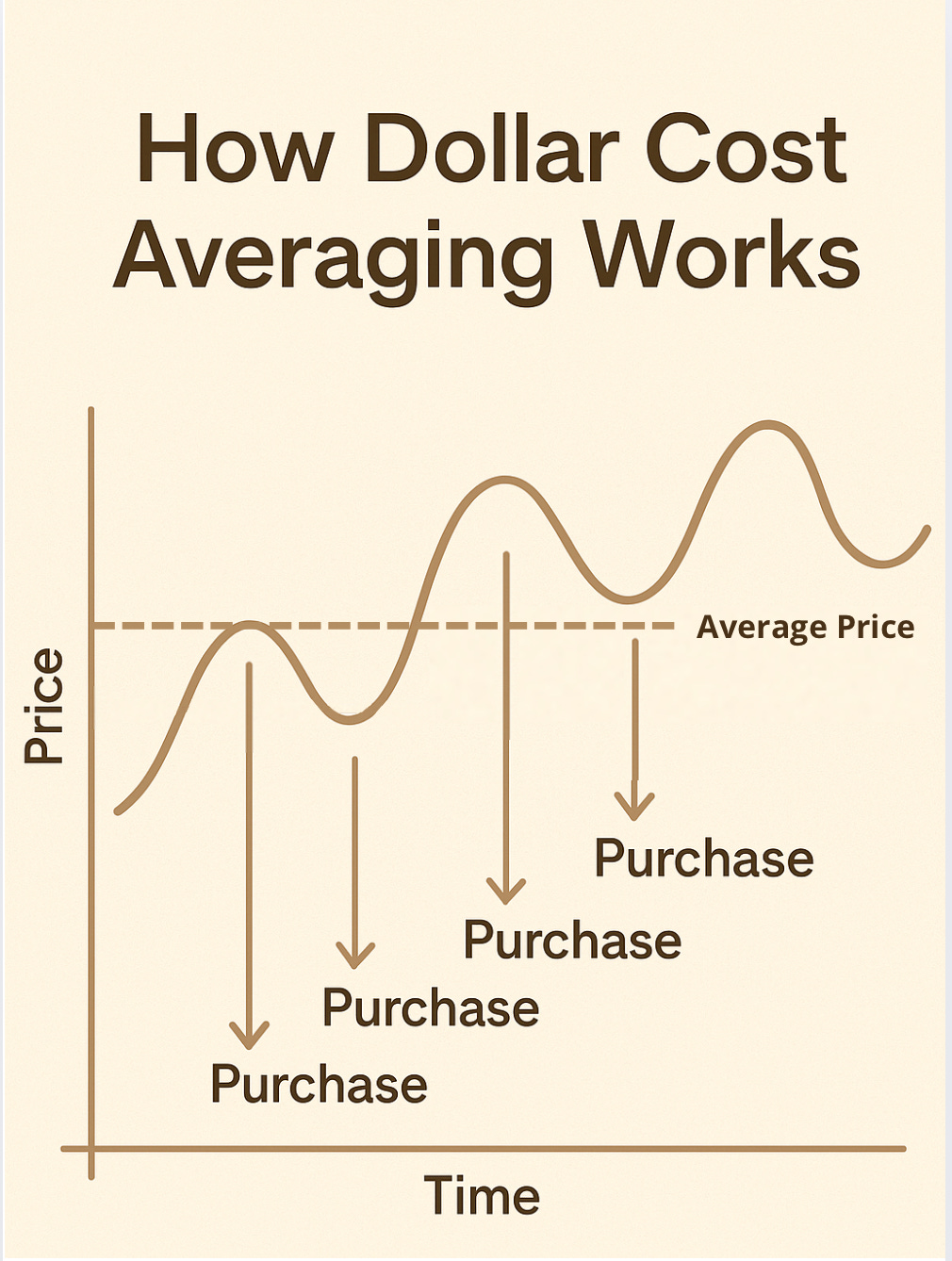

When it comes to building wealth or preparing for the future, most people eventually face the classic dilemma: should I invest everything at once, or is it better to spread out my investments over time? This question sits at the heart of one of the most widely used — and misunderstood — investment approaches: the Cost Averaging Capital Accumulation Plan (CACP).

If you want to learn more about differences between Cost Averaging and Lump Sum, I made this post some years ago.

On the surface, a CACP feels intuitive. It’s systematic, disciplined, and simple to automate. For many, it’s not just an investment strategy — it’s a way to enforce savings, turning small periodic contributions into a long-term financial habit. But like any method, CACP isn’t without criticism. Some argue it provides a false sense of security or that its effectiveness depends entirely on market conditions and timing.

In upcoming posts, we’ll unpack these nuances. We’ll explore how CACP compares to lump-sum investing, the psychological side of gradual capital deployment, and the potential of using such plans as retirement tools. We’ll also tackle some of the common misconceptions — including the real risks involved and why academic theory doesn’t always align with investor experience.

If you’ve ever wondered whether cost averaging is the right path for you, or simply want to understand how this approach shapes long-term financial outcomes, stay tuned. Over the next few posts, we’ll dive deep into the mechanics, benefits, and limitations of capital accumulation strategies — beyond the textbook theory, with a focus on what truly matters: consistency, emotional resilience, and achieving your financial goals.