Often, we dive deep into complex financial theories, only to rediscover the basic, timeless truth: building wealth requires discipline, patience, and a strategy that fits not just our portfolio, but our human nature.

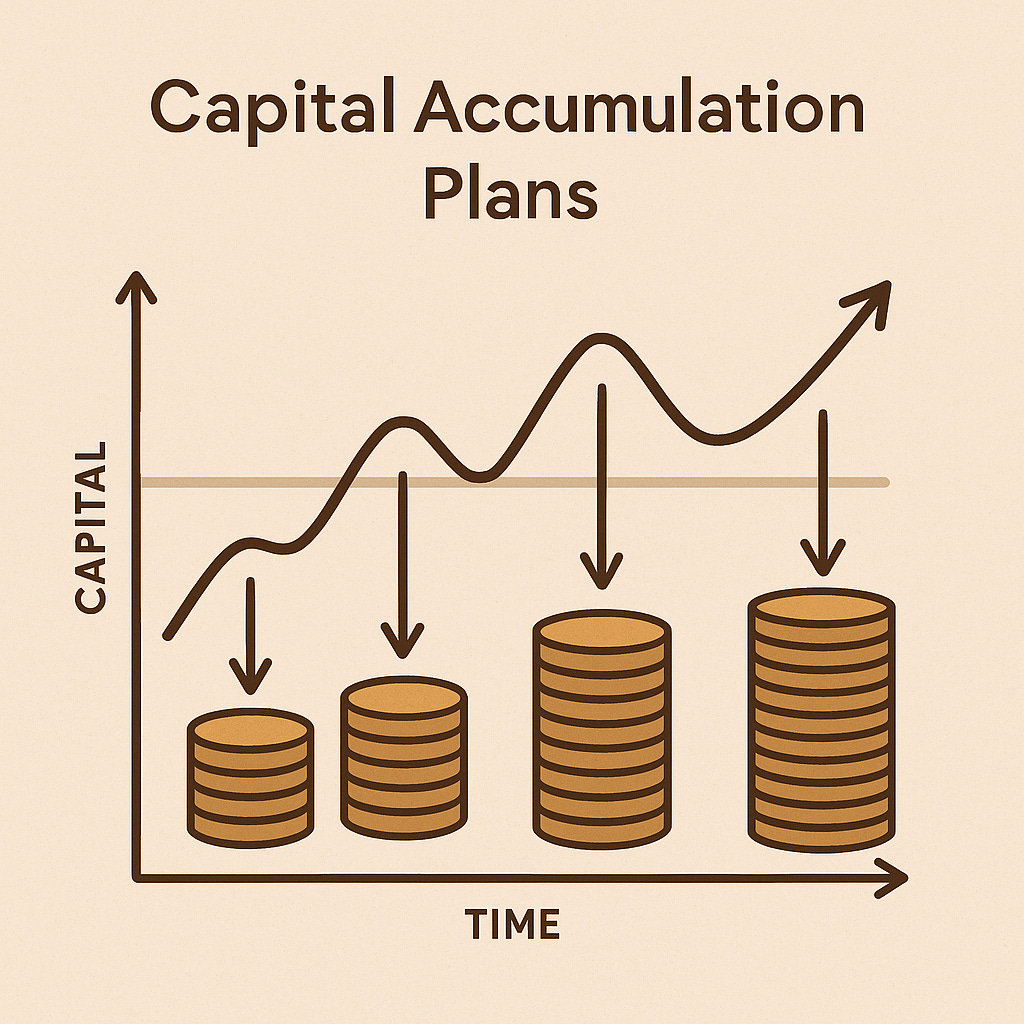

At its core, a Capital Accumulation Plan (CAP) with constant installments is one of the simplest, most widely used investment methods. It’s not just about chasing returns — it’s about building discipline, creating a habit of saving, and gradually accumulating capital over time. The great strength of CAP lies in its accessibility: it doesn’t require a large sum upfront. For many, especially those who rely on monthly income from work, it’s the only realistic way to build wealth consistently.

Dollar Cost Averaging: The Classic CAP

The Anglo-Saxon world often refers to this as Dollar Cost Averaging (DCA). But here’s a nuance: financial theorists often assume that when discussing DCA, the entire capital is available from day one, just invested gradually. In practice, this isn’t how most people operate. Many investors simply don’t have €10,000 or €100,000 sitting in their account ready to deploy — they invest €100, €500, €1,000 a month as they earn.

So, does comparing DCA to a lump sum investment even make sense for most people? From a strict academic lens, yes. But from the perspective of real-life investors? Not always.

The Psychological Reality

Here’s where Behavioral Finance becomes critical — and this is where my opinion comes in: too often, classical finance ignores how humans actually behave. Investing a lump sum might yield higher returns on paper, but it also carries more psychological stress. Anyone who’s watched markets swing knows how emotionally taxing it can be to see your full capital exposed to volatility from day one.

In contrast, a CAP introduces risk gradually. Ironically, early market downturns actually benefit long-term CAP investors — you acquire more units at lower prices. When you only have a few installments invested, temporary losses hurt less.

Value Averaging: A Hybrid Approach

Beyond the classic CAP lies Value Averaging (VA) — a fascinating hybrid between CAP and lump-sum investing. VA adjusts the amount invested each period to keep your portfolio aligned with a pre-set growth trajectory.

Critics have been harsh on VA, pointing out flaws like distorted return calculations due to excess liquidity or complexity in implementation. But I believe these critiques sometimes throw out the baby with the bathwater. When executed with care, VA offers a smart compromise — blending discipline with flexibility, while minimizing emotional strain.

The Bigger Picture

To me, the real takeaway is this: Investment strategy isn’t just math. It’s mindset.

Peace of mind is worth more than chasing marginally higher returns — especially for non-professional investors. Excessive caution can paralyze us, while reckless optimism can derail us. CAPs — whether constant or value-averaged — give structure, reduce decision fatigue, and help investors stay in the market without obsessing over perfect timing.

Yet, parts of academia still resist incorporating Behavioral Finance insights. But markets aren’t machines, and neither are we. As the Nobel-winning work in Behavioral Economics shows, so-called “irrational” behavior is often entirely rational for the emotional, human investor.

Final Thought

As Meir Statman predicted back in 1995: “The practice of dollar-cost averaging will persist.” Decades later, it not only persists — it thrives. And for many, it’s not just a method — it’s peace of mind, structure, and the quiet, steady path to financial independence.